Economic Outlook: Source

- As of March 1, the latest data available, the Internal Revenue Service reported that the average refund was up 5.1% from $3,028 during a similar timeframe through March 3, 2023. That is 3% higher than reported two weeks back.

- The flipside: The number of tax refunds issued so far is down from a year ago. The IRS issued 36.28 million tax refunds through March, down 13.7% from a year ago.

- The total amount refunded through March 1 was nearly $115.5 billion, down 9.3% from a year ago.

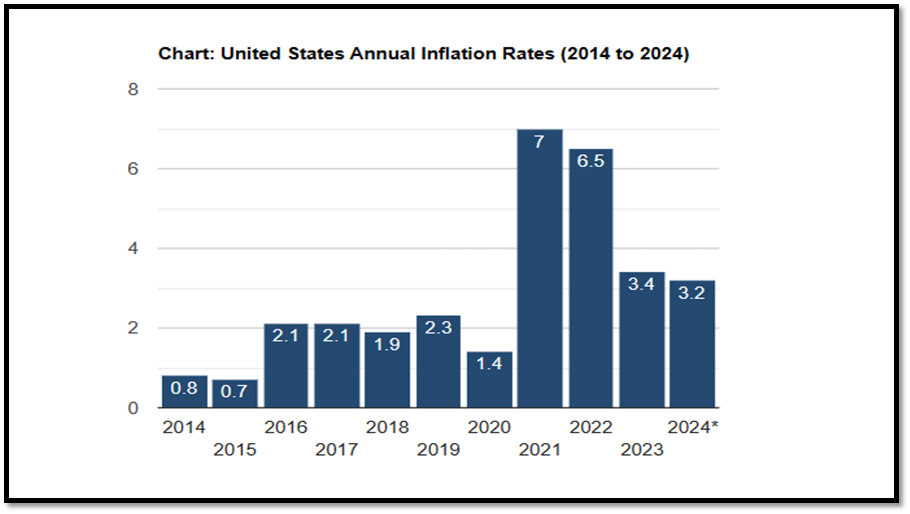

- As inflation relief stagnates, more consumers walked away from or traded down on pricey goods and services in February than in previous months.

- Middle-income adults’ demand has fallen more in line with that of the lowest income group as these consumers increasingly rely on cost-saving measures, while high earners fuel demand growth.

New and Used Retail Sales and Day Supply Trending: Source

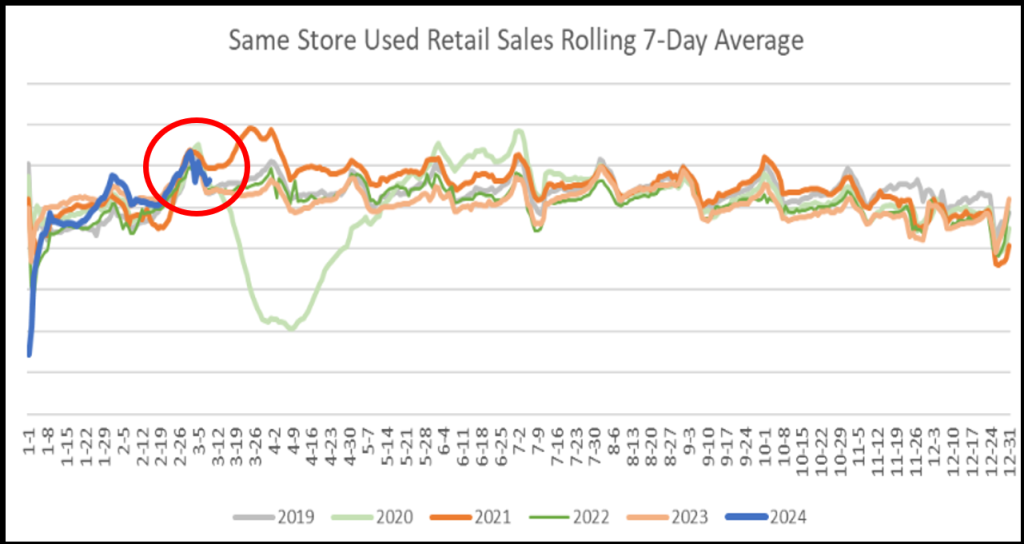

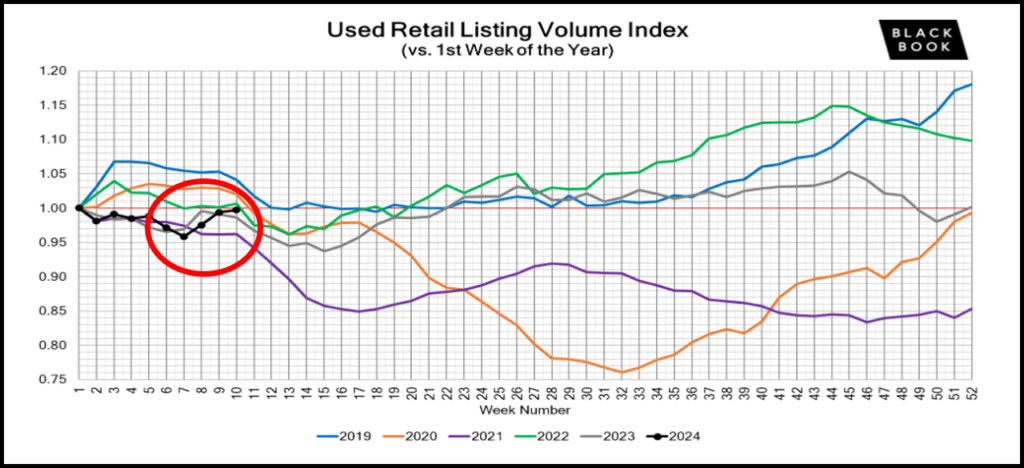

Total new-light-vehicle sales were up 9.6% in February from a year ago, with one more selling day than February 2023. By volume, new-vehicle sales were up 16.6% from January. Cox Automotive used retail sales estimates based on veto data indicating that sales volumes were up 18% in February compared to January, with volumes up 5% from a year ago. Certified pre-owned (CPO) sales increased 5% from January and were up 2% from a year ago. The sales rate dropped lower in early March but still ahead of most previous years.

Manheim Wholesales Market Source

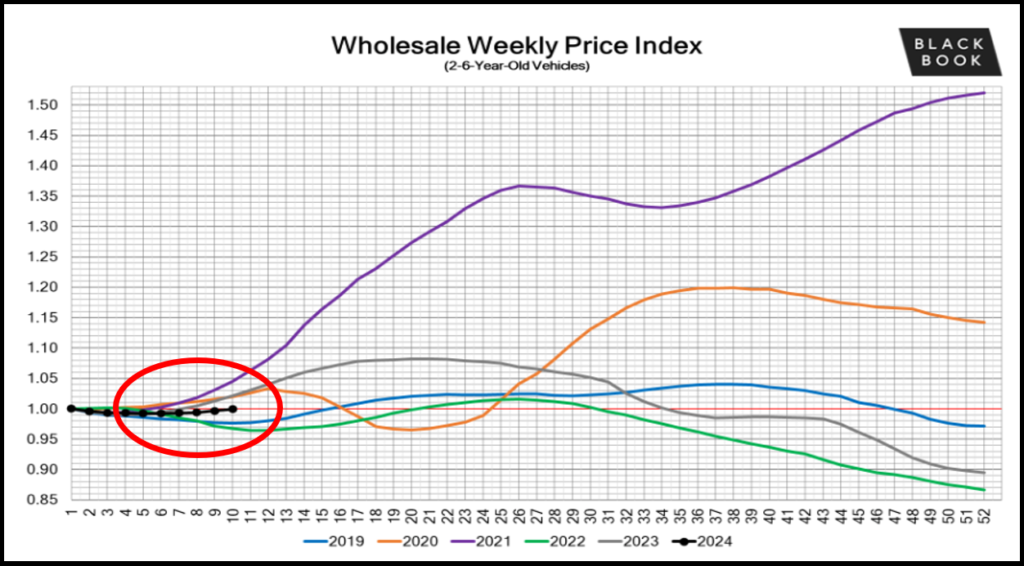

The Spring wholesale market continues. Three-year-old wholesale values increased 0.8% (+0.9% last week), lane efficiency increased some, and sale prices slightly ahead of MMR. Used retail sales still strong compared to most previous years and days’ supply still relatively low. New car sales still trending higher than some previous years, but days’ supply generally increasing as inventory grows.

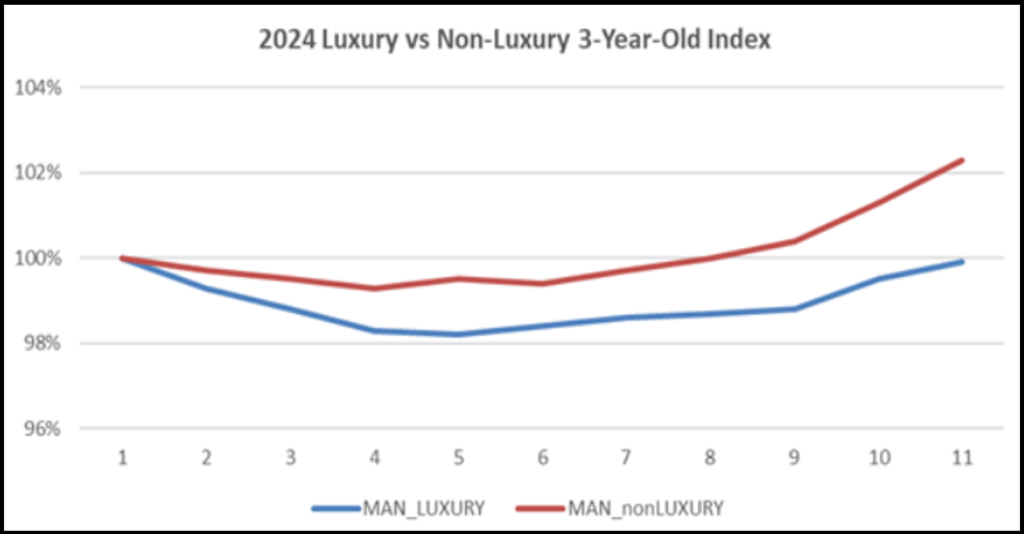

- The 3-year-old index moved up 0.8% to 101.5%. Luxury increased 0.4% and non-luxury increased 1.0%.

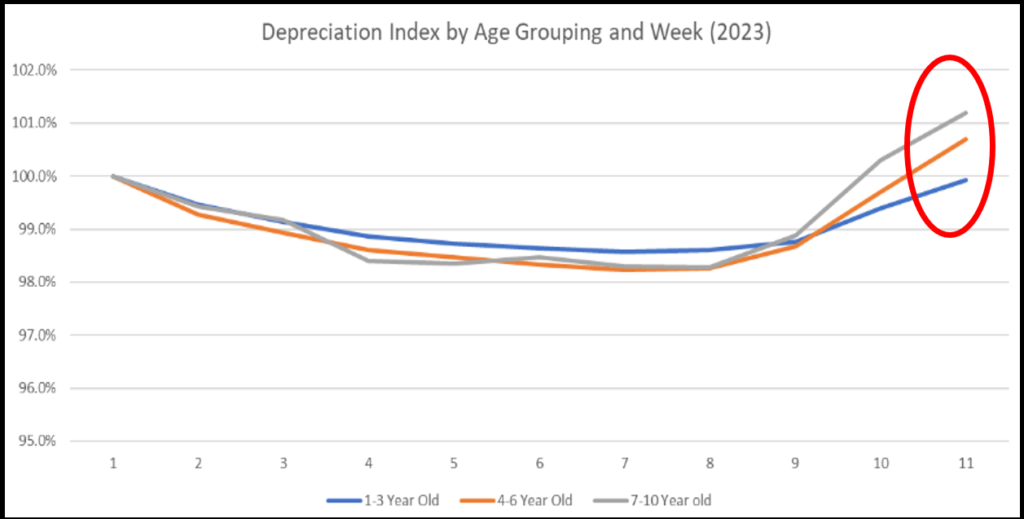

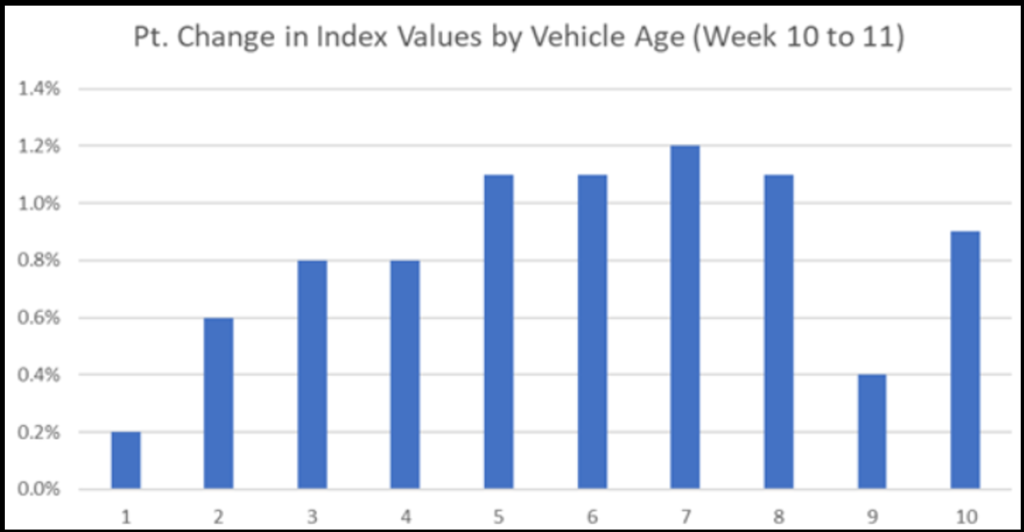

- Wholesale values increased for all age vehicles; 5 – 8 year-old vehicles increased the most.

- Sale prices moved slightly ahead of MMR (+0.04%).

- Lane efficiency increasing some but likely peaking for the Spring market.

- Retail prices dropped some last week, and spreads continue to drop due to increasing wholesale values and dropping retail prices.

- The sales rate dropped lower in early March but still ahead of most previous years. Days’ supply still low at 38 days.

- New car sales continue to trend higher than some previous years, but inventory also continues to build. Days’ supply moved back up to 77 at the beginning of March.

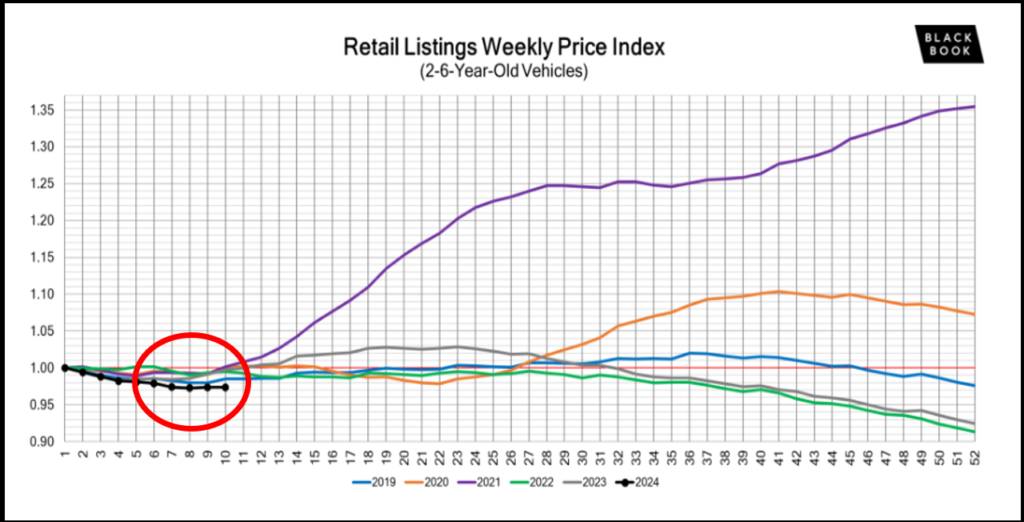

The depreciation index continues to be inverted and looking back three weeks the rate of value increases in the used car market by year segments has been significant to the tune of three and 4% growth in just a few short weeks. This is the concept of what feels like today is underpaying tomorrow. On the flip side this is the valuations of your aging inventory on lot. Having a wholesale acquisition strategy in this market to replenish fresh inventory, considering replacement cost, is important in this market as well

Black Book: Source

Recapping the first full week of March, the wholesale market exhibits further improvement, with three truck and three car segments reporting positive movement, signaling the commencement of the spring market. The mood in the auction lanes is upbeat, a sentiment echoed by a 2% increase in auction conversion rates compared to the previous week, alongside a slight reduction in auction inventory. This combination of factors points to a growing optimism within the market.

As always, our team of Analysts are focused on keeping their eyes on the market, watching for developing trends, and gathering insights. The estimated Average Weekly Sales Rate was improved to 57%.

Vehicle Acquisition Values & Trends:

Following the same trend of last week, every model year of inventory below is showing an increase in value week over week with the seven and eight-year-old segment growing the most affordability is impacting this categorization spread and will continue through weeks 15 and 16 most likely. Having a weekly buy plan would define goals to reach each day and week based on sales rate will be critical in this market

Manheim Wholesales to Retail Trending: Source

Looking at the wholesale to retail spread below, you can see the margin compression is significant and I’m luxury and behaving the same way in luxury. Focusing on front in gross in this market dynamic instead of departmental gross has shown to increase inventory aging and reduce turn causing negative consequences.

Summary: Source

Coming off a strong February, the first couple of weeks of March have shown a softening of sales rate but not a softening of acquisition costs. Considering the fact that we are 25% behind and refunds to date compared to last year, the runway may be longer, but it also may not peak at the same time period last year; this time in March was the peak. The good news is our selling season will be longer, but we need to manage sales rate and market conditions to stay profitable and balance to the market with our inventory acquisition strategy. Reach out to the team for a discussion on your strategy. info@theautomotiveadvisorteam.com