Economic Outlook: Source

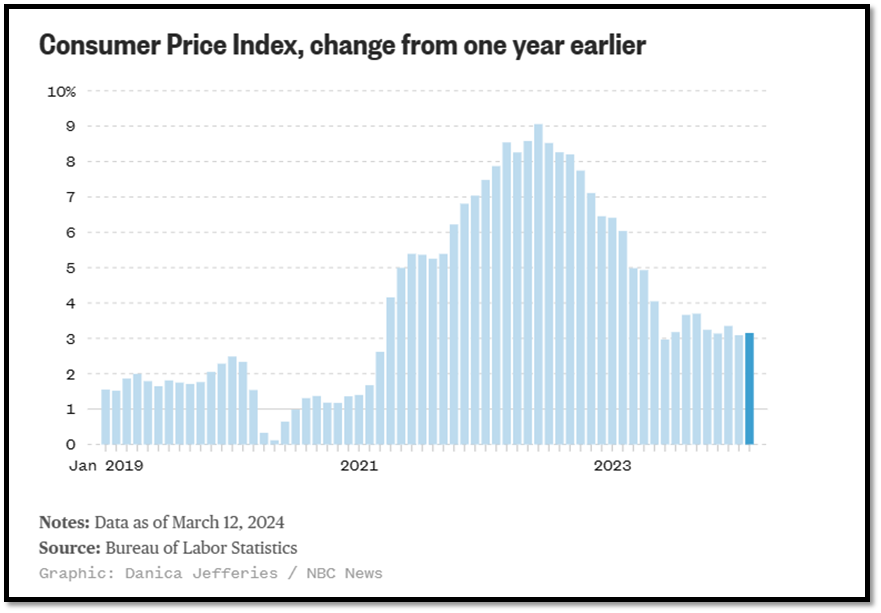

Federal Open Market Committee noted that job gains remain strong, and unemployment remains low, while price growth remains elevated, even as it has cooled since peaking in 2022.

As a result, the committee said it intends to keep the interest rate at the current level until it has more confidence that inflation is on a sustained track toward its official 2% goal.

However, Inflation rebounded in the first quarter of 2024 after cooling in the second half of 2023.

- Prices of gasoline and diesel rose as OPEC+ producers extended supply cuts; Ukraine’s military attacked Russian refineries production leveled off near a record high.

- Prices of some agricultural products, including chicken and beef, rose as well.

Retail Sales and Supply Trending: Source

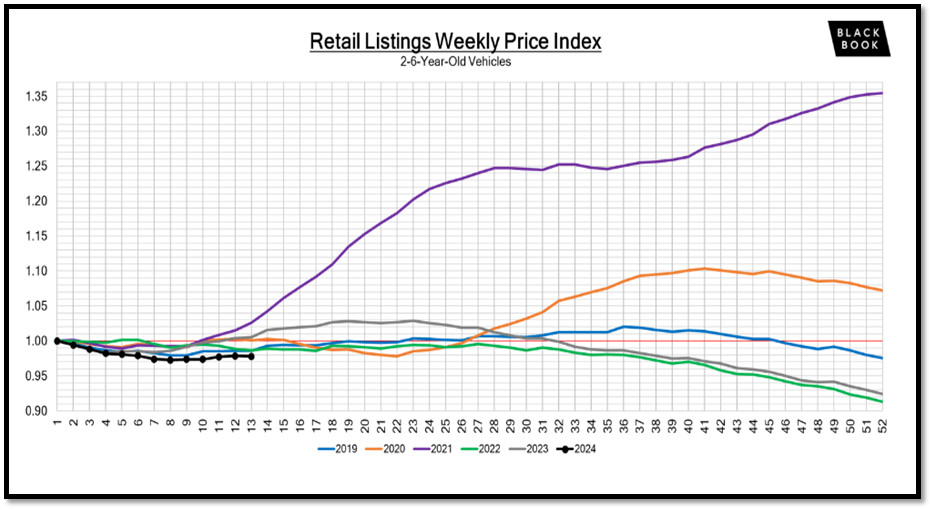

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

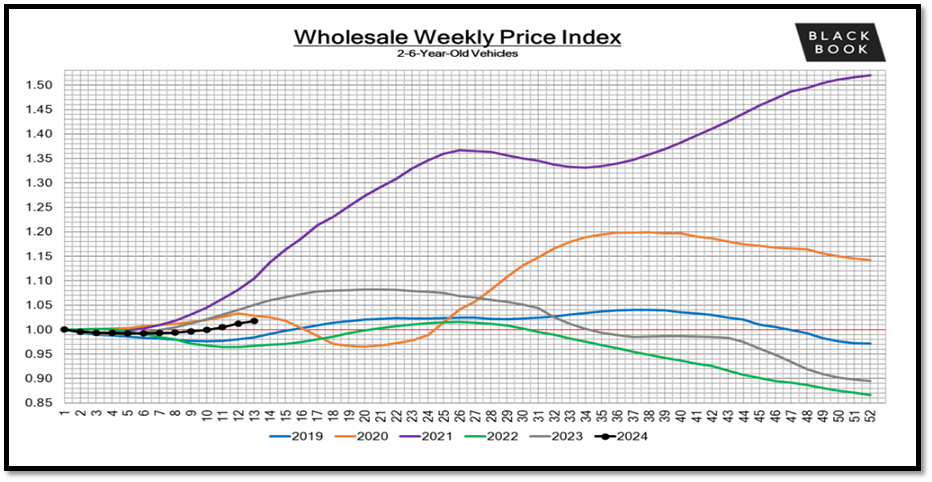

This analysis is based on approximately two million vehicles listed for sale on U.S. dealer lots. The graph below looks at 2-to-6-year-old vehicles. The Index is computed keeping the average age of the mix constant to identify market movements.

Cox Automotive New and Used Retail Outlook: Source

- Retail prices dropped slightly. Six-week lagged spreads continue to drop due to increasing wholesale values and flat or decreasing retail values.

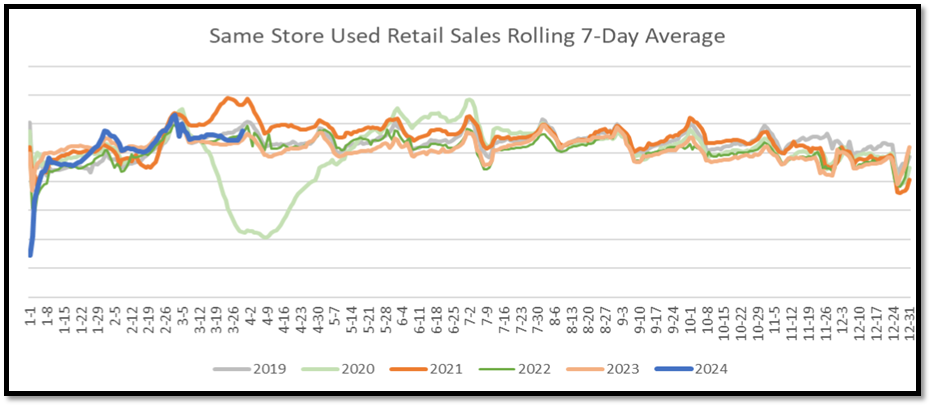

- The used retail sales rate increased again but remained similar to most previous years.

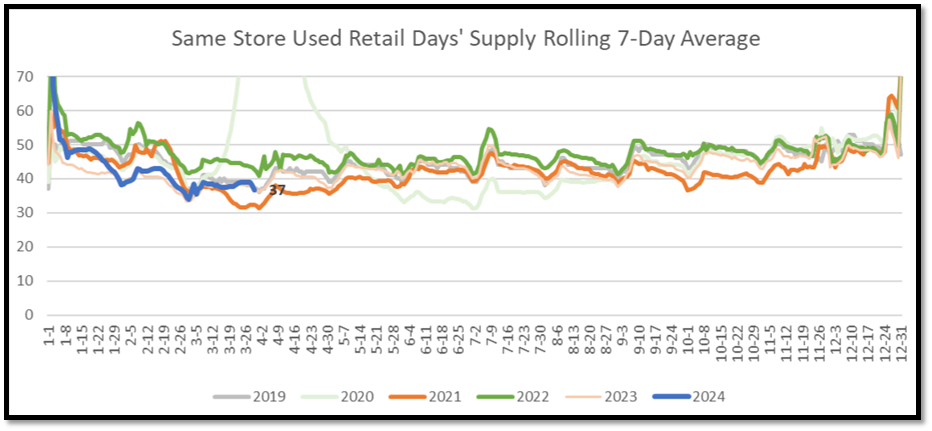

- Days’ supply is still low at 37 days.

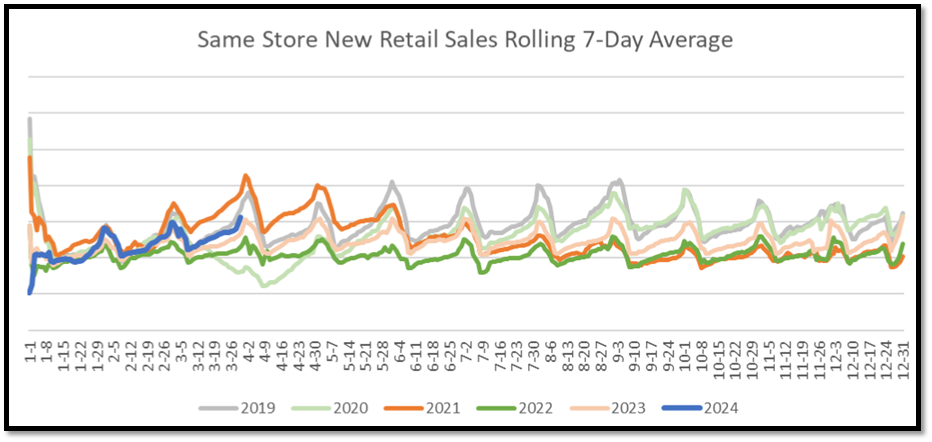

- New car sales are still moving up, but March month ends lower than 2019.

- Days’ supply moved down to 58 days at the end of the month.

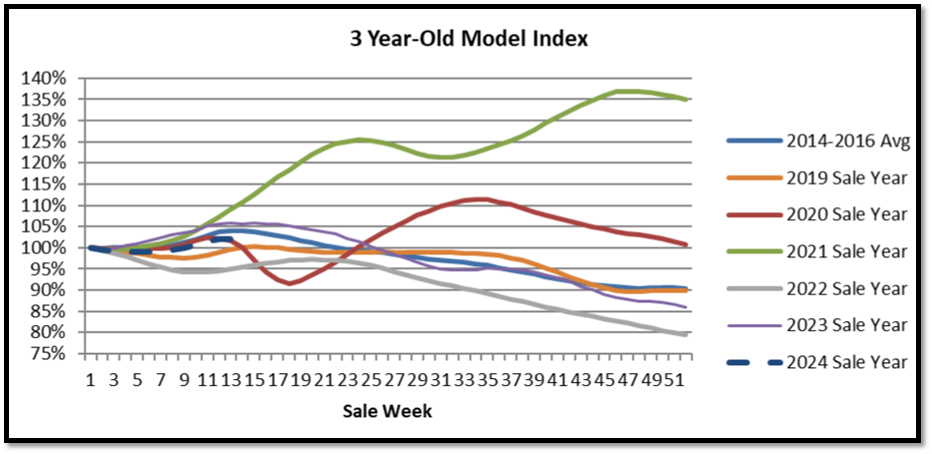

Cox Automotive’s Manheim Wholesales Market Source

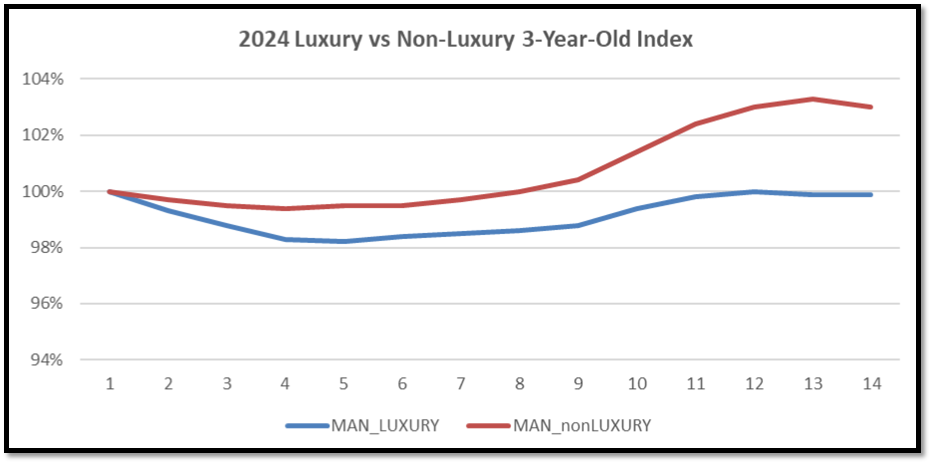

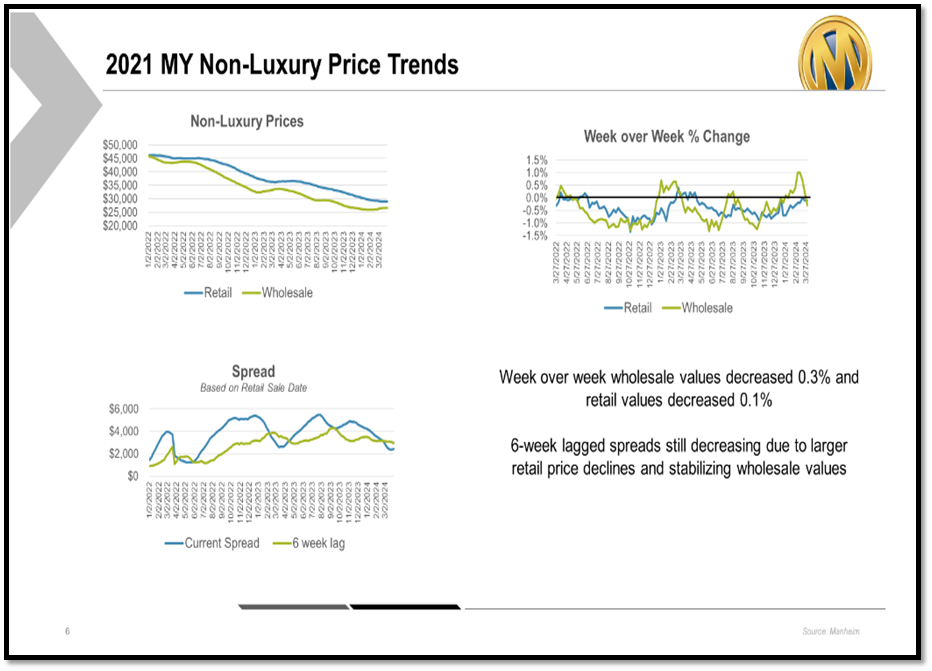

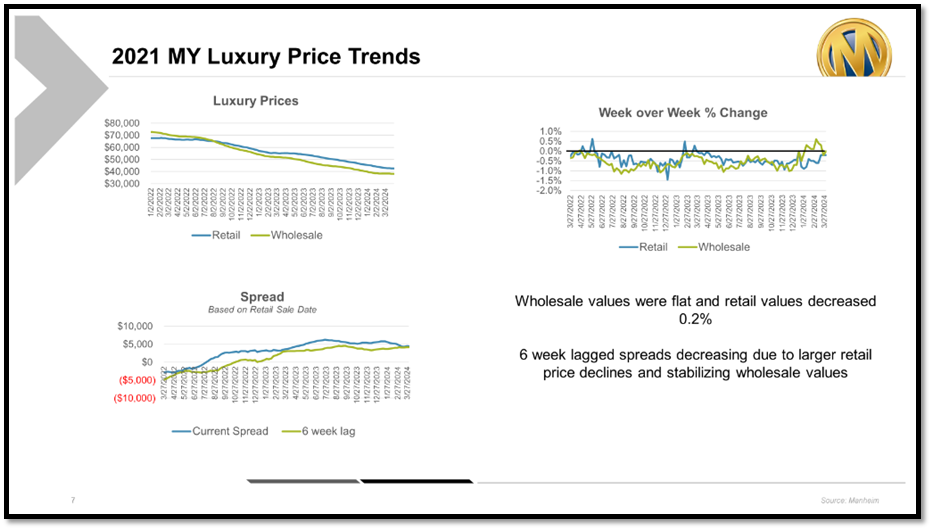

- Changing direction, the 3-year-old index dropped 0.1% to 102.0%. Luxury was flat and non-luxury decreased by 0.3%.

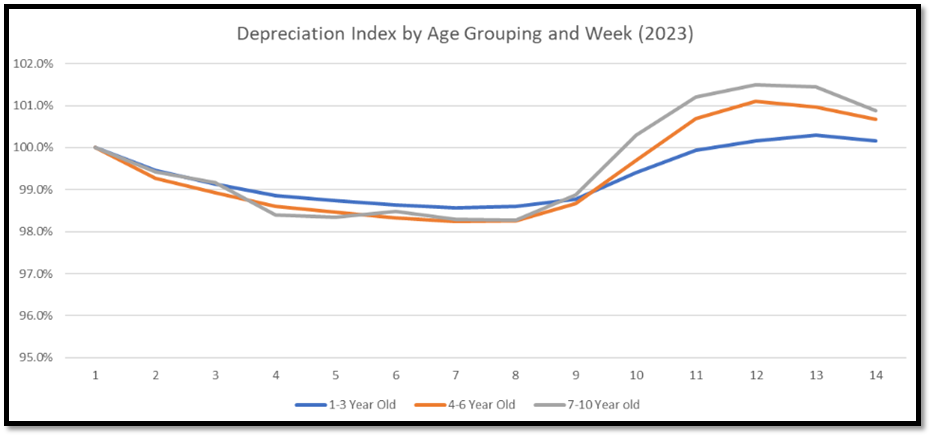

- Wholesale values decreased for all model years, most notably for older model years.

- Sale prices below MMR (-1.15%) with lane efficiency plateauing.

- Retail prices dropped slightly. Six-week lagged spreads continue to drop due to increasing wholesale values and flat or decreasing retail values.

- The used retail sales rate increased again but remained like most previous years.

- Days’ supply is still low at 37 days.

- New car sales are still increasing, but March month end is lower than 2019.

- Days’ supply moved down to 58 days at the end of the month.

Black Book: Source

- Market momentum is accelerating, evidenced by a +0.39% increase in values from last week.

- Auction activity is bustling, characterized by strong conversion rates and vigorous bidder participation.

- The lone area not mirroring this positive trend is the used electric vehicle sector, which persists as the market’s current underperformer, with high no-sale rates and declining values.

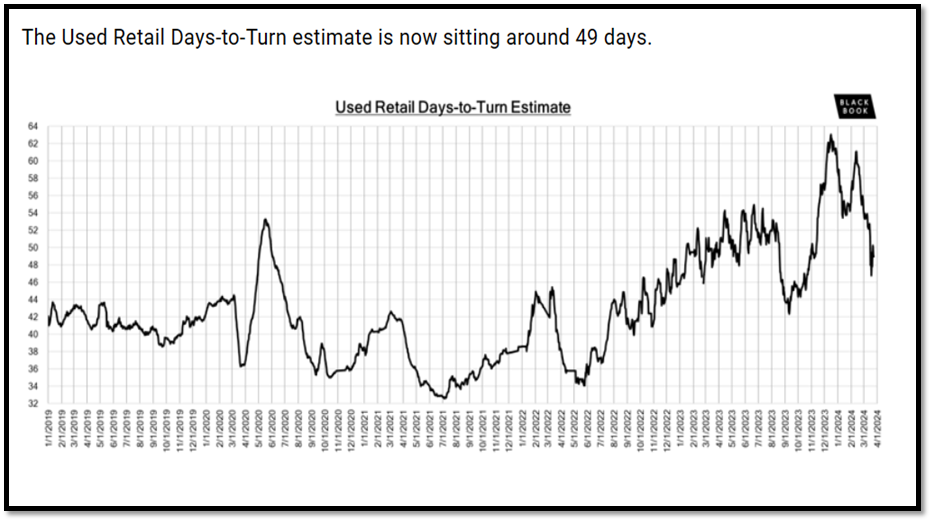

- The Used Retail Days-to-Turn estimate is now sitting around 49 days.

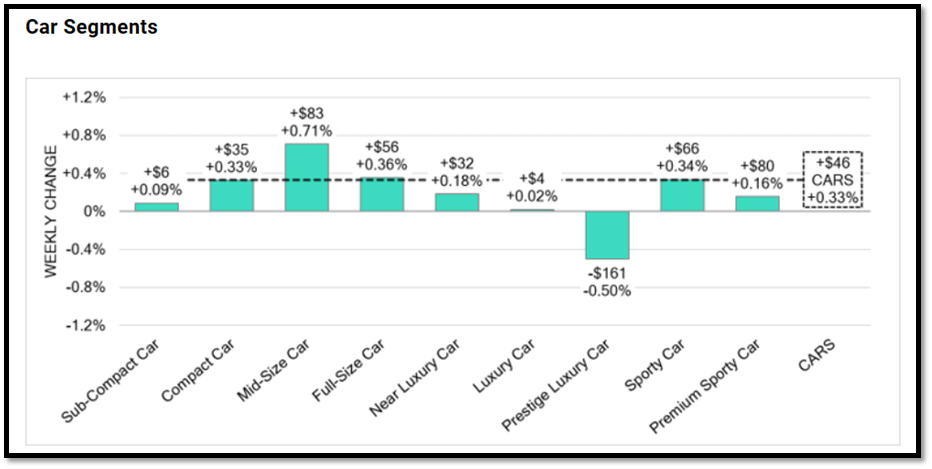

- Car segment increased +0.33%. For reference, in the previous week, cars increased +0.10%.

- The 0-to-2-year-old Car segments were up +0.24% and 8-to-16-year-old Cars increased +0.21% w/ eight of the nine Car segments increased last week.

- Last week, the Prestige Luxury Car segment was the sole category to witness a decrease in value, with depreciation deepening by -0.50%, compared to -0.19% the previous week. A notable factor in this heightened rate of depreciation was the decline in the value of the Tesla Model S.

- The Mid-Size Car segment saw the most significant uptick in value last week, appreciating +0.71%. This surge marks the segment’s largest single-week gain since the beginning of March 2023.

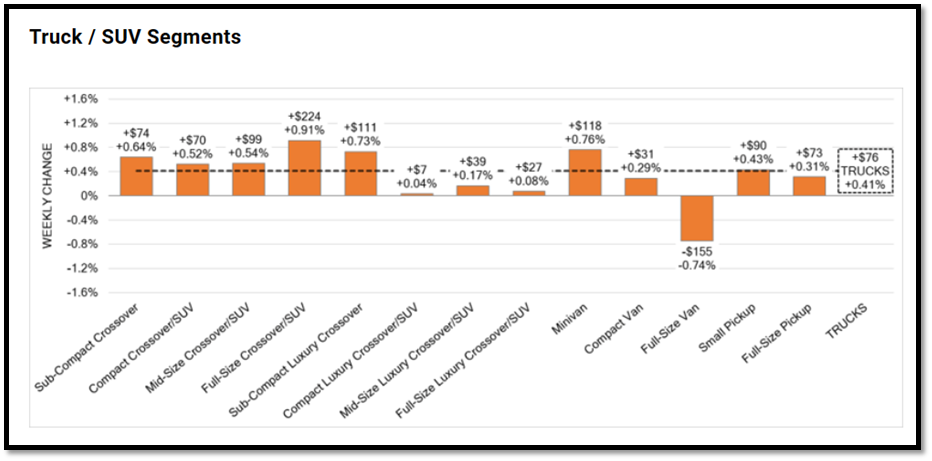

- The Truck segment increased +0.41% compared to the appreciation last week of +0.15%.

- The 0-to-2-year-old models gained +0.27% on average and the 8-to-16-year-olds increased by +0.14% on average w, twelve of the thirteen Truck segments increased last week.

- Last week, the Full-Size Pickup segment saw an acceleration in its value growth, appreciating by +0.31%, which was a notable jump from the previous week’s modest rise of +0.02%.

- Last week, the Full-Size Crossover/SUV category experienced the most substantial growth, with a +0.91% rise in value. This represents the segment’s biggest one-week surge since spring 2021.

Retail Margin Trending

Summary:

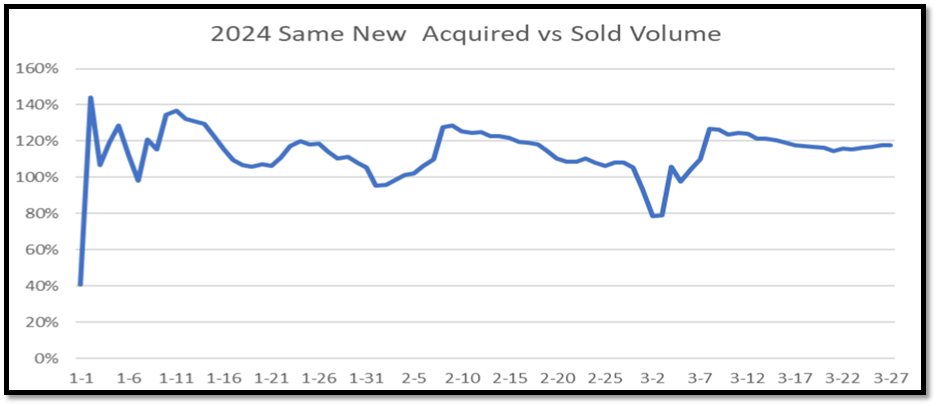

Last week we saw a softening in the market and this week we see an acceleration in both retail sales and used car values. We can expect this up-and-down trend to continue for the next few weeks as the market begins to shift out of tax season and completely into the spring selling season.

It will be critical over the next couple of months to manage your inventory inflows based on a calculated plan that maximizes market conditions and current sales rate growth.

Read more HERE and reach out to the automotive advisor team if you need help putting that plan together.