Economic Outlook: Source

As we edge closer to the tax deadline, recent data reveals an intriguing trend: the Internal Revenue Service (IRS) reported receiving 90.3 million returns by March 29, marking a 0.2% increase from the previous year. The average tax refund has risen by 4.8% to $3,050.

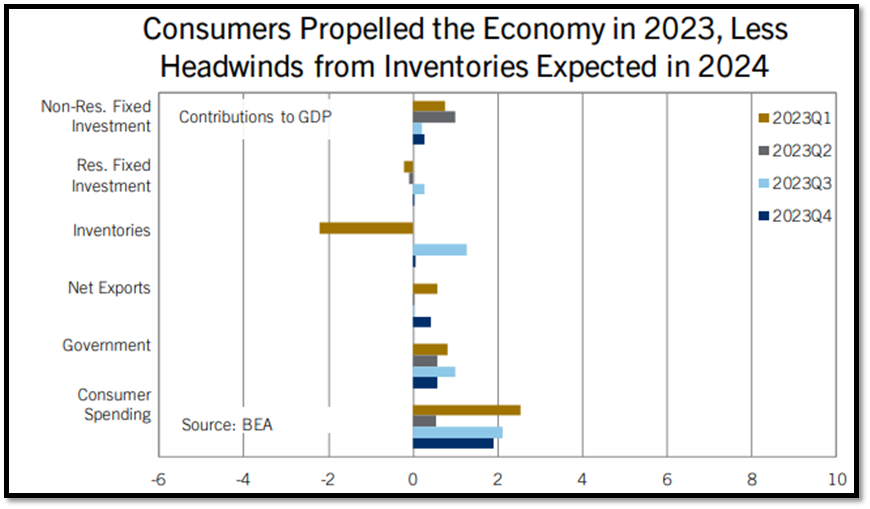

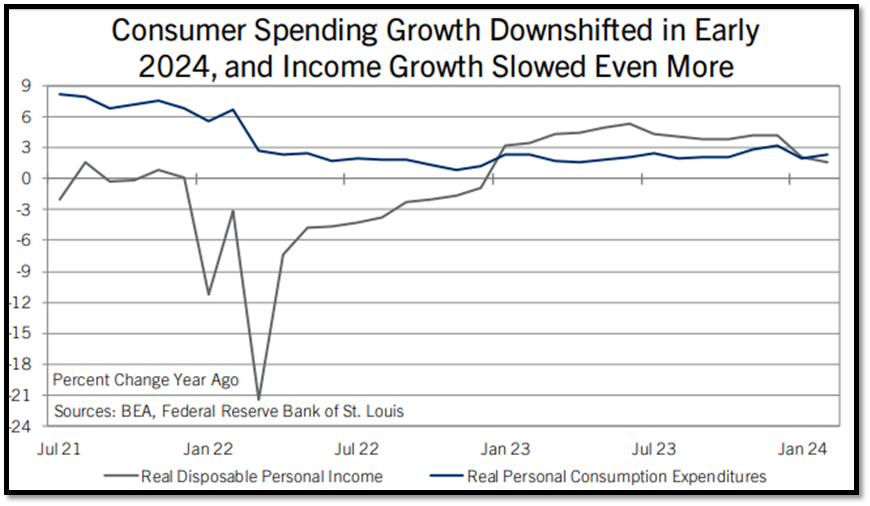

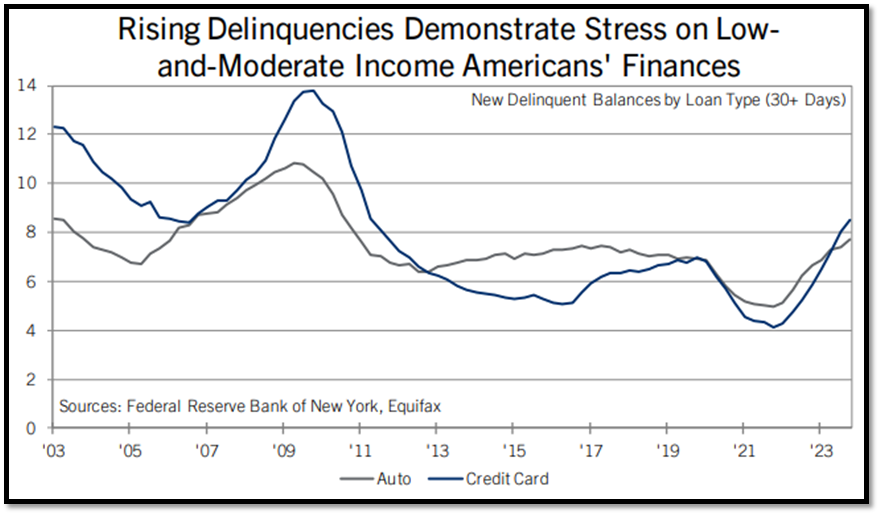

With the positive momentum coming out of tax season, the inflationary momentum that built up over the last few years is taking a while to peter out. As a result, the U.S. economy’s key price indexes, including the CPI and PCE, moved sideways in early 2024 at levels above those consistent with the Fed’s inflation target.

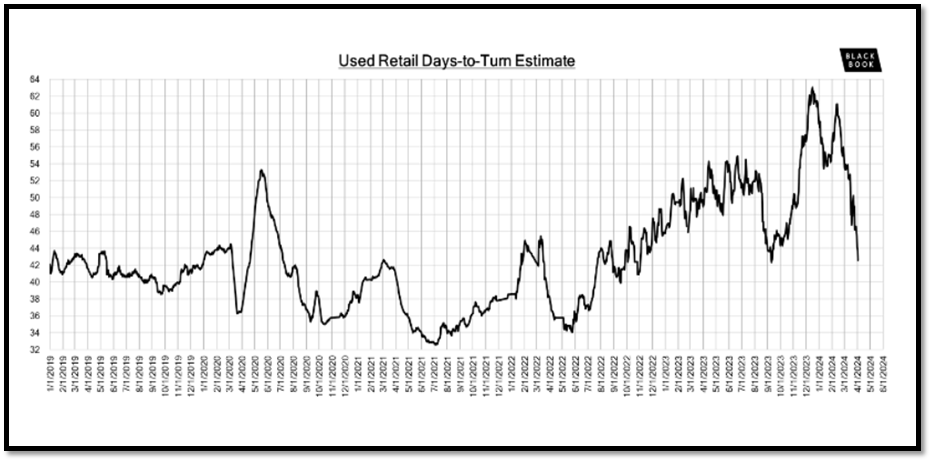

Thinking through that for Automotive, increased returns have been what fueled the sales so far this year and decreased used day supply keeping used car prices up. However, these economic indicators tell us interest rate pull backs are less likely especially more than one when three was expected earlier in the year. That will require us to keep a tight ship throughout 2024 knowing a rate pull back demand stimulus is unlikely.

Retail Sales and Supply Trending: Source

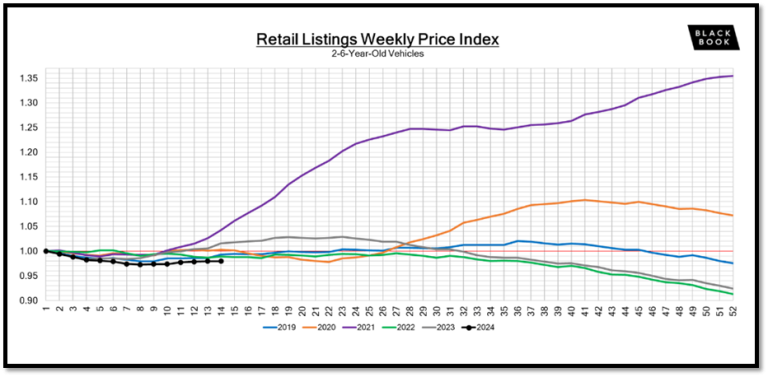

- Retail prices dropped slightly. Six-week lagged spreads continue to drop due to increasing wholesale values (until last week) and flat or decreasing retail values.

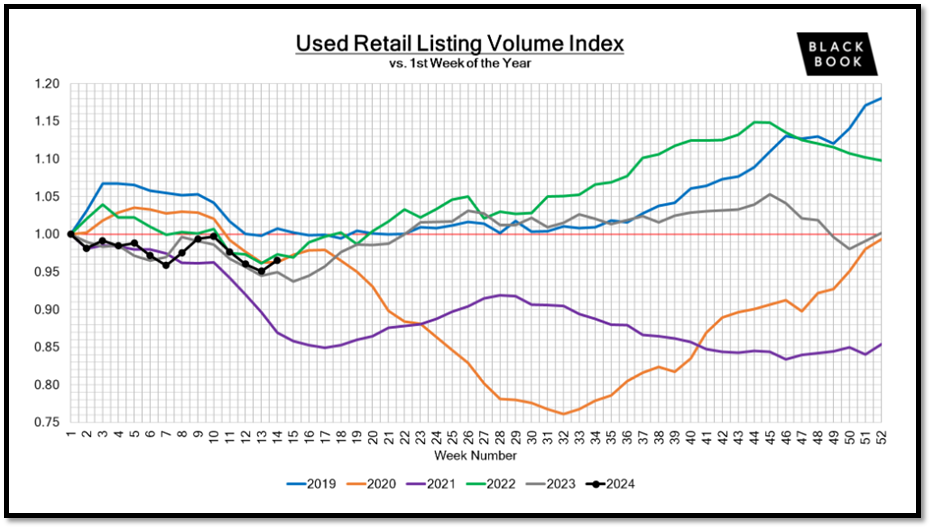

- The used retail sales rate is now slightly lower than in most previous years. Days’ supply moved up to 42 days.

- New car sales are still moving up, but late March/early April is lower than 2019. Days’ supply moved up to 68 days.

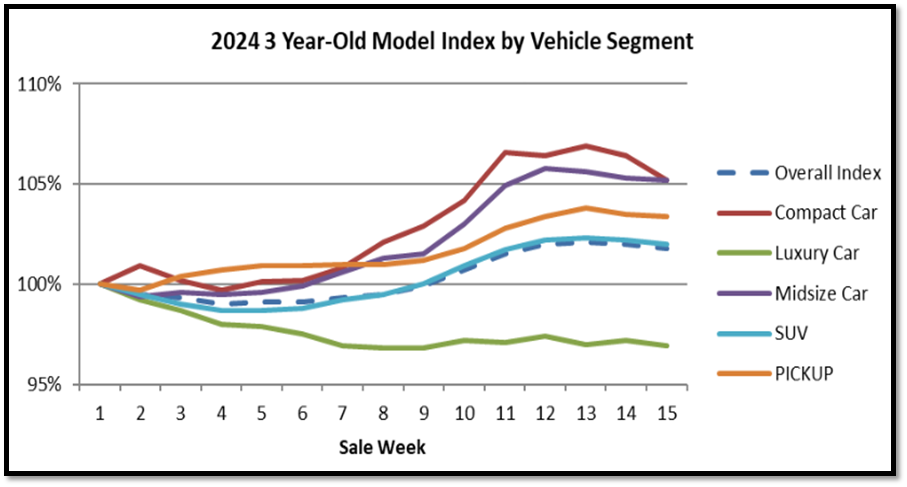

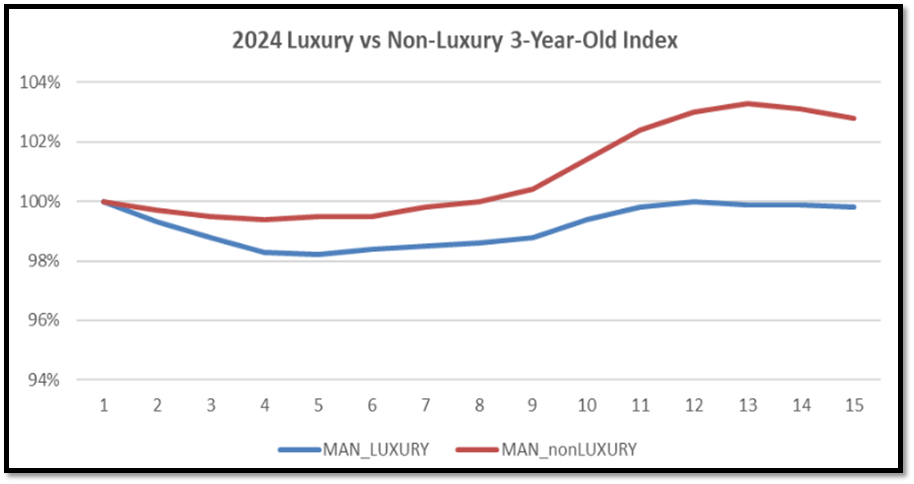

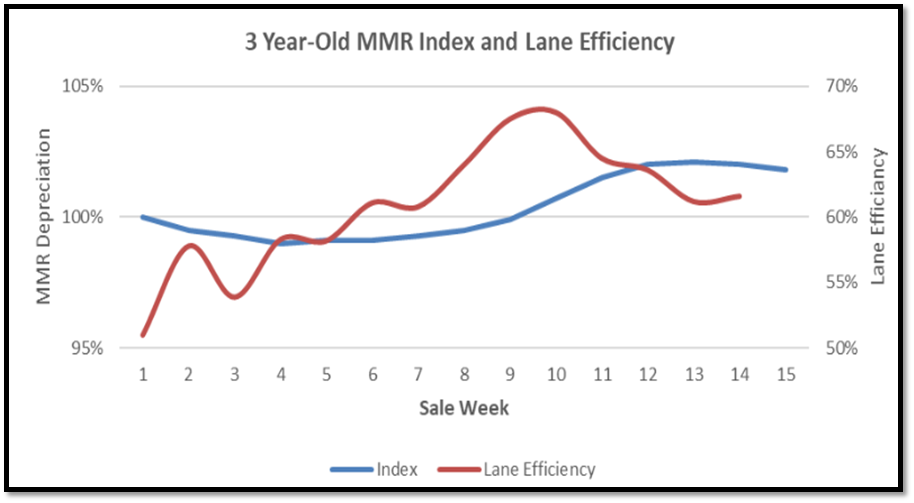

Cox Automotive’s Manheim Wholesales Market Source

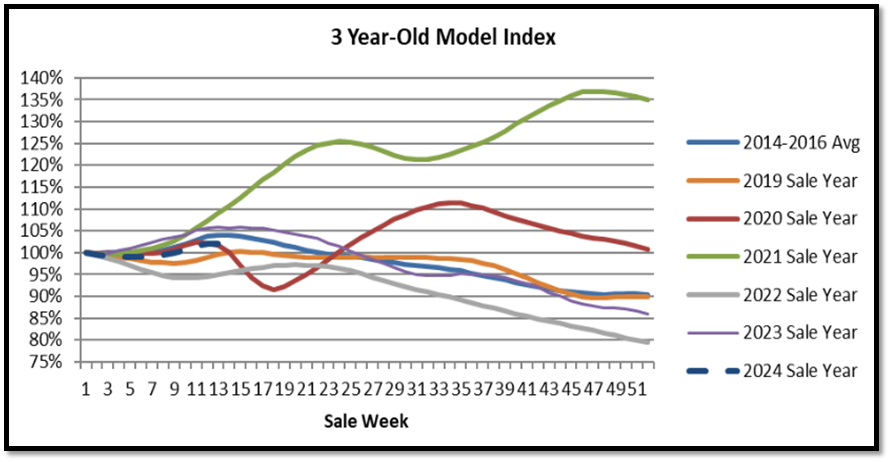

- The 3-year-old index moved down 0.2% to 101.8%.

- Non-luxury down 0.3% and luxury down 0.1%

- Luxury: Luxury cars down 0.3%; SUVs down 0.1%

- Non-Luxury: Compact cars down 1.2%; Midsize cars down 0.1%; Midsize SUVs down 0.4%.

- Entry SUVs up 0.15 & Pickups are down 0.1%.

- Lane efficiency went up 0.4% to 61.6%.

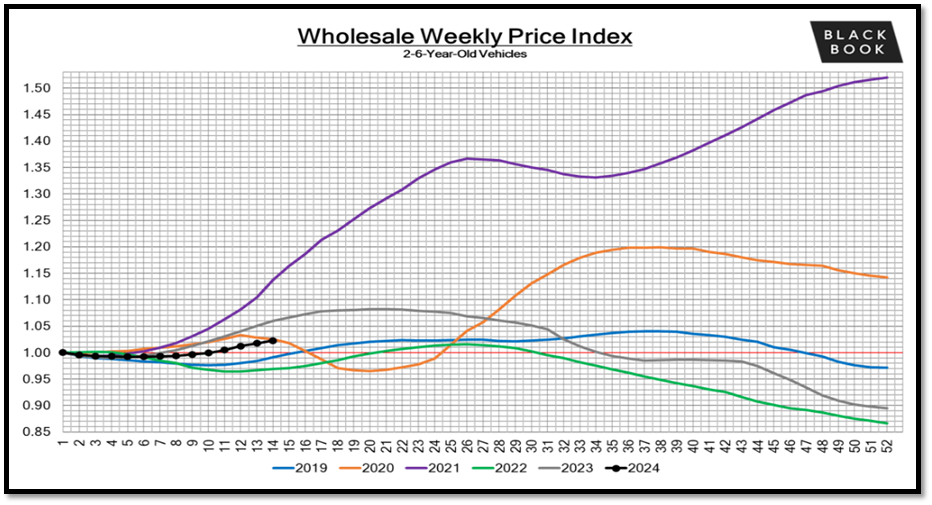

Black Book: Source

Last week, the wholesale market still showed an uptrend with prices incrementally increasing. Yet, the pace of those increases moderated, evidenced by a +0.24% gain compared to a +0.39% gain the week prior. The conversion rate also experienced a minor decline, reflecting heightened buyer prudence following a period of quick price escalation.

- On a volume-weighted basis, the overall Car segment increased +0.26%. For reference, in the previous week, cars increased +0.33%.

- The 0-to-2-year-old Car segments were up +0.25% and 8-to-16-year-old Cars increased +0.22%.

- Seven of the nine Car segments increased last week.

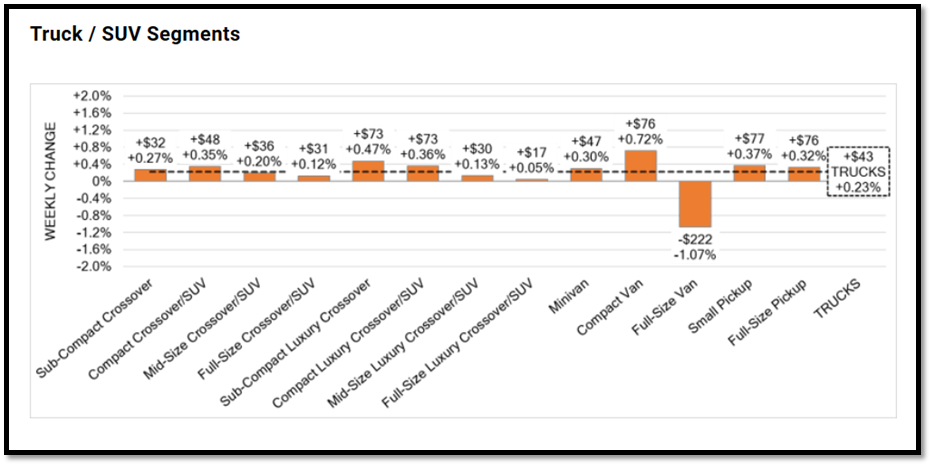

- The volume-weighted overall Truck segment increased +0.23% compared to the appreciation seen the prior week of +0.41%.

- The 0-to-2-year-old models gained +0.11% on average and the 8-to-16-year-olds increased by +0.00% on average.

- Twelve of the thirteen Truck segments increased last week.

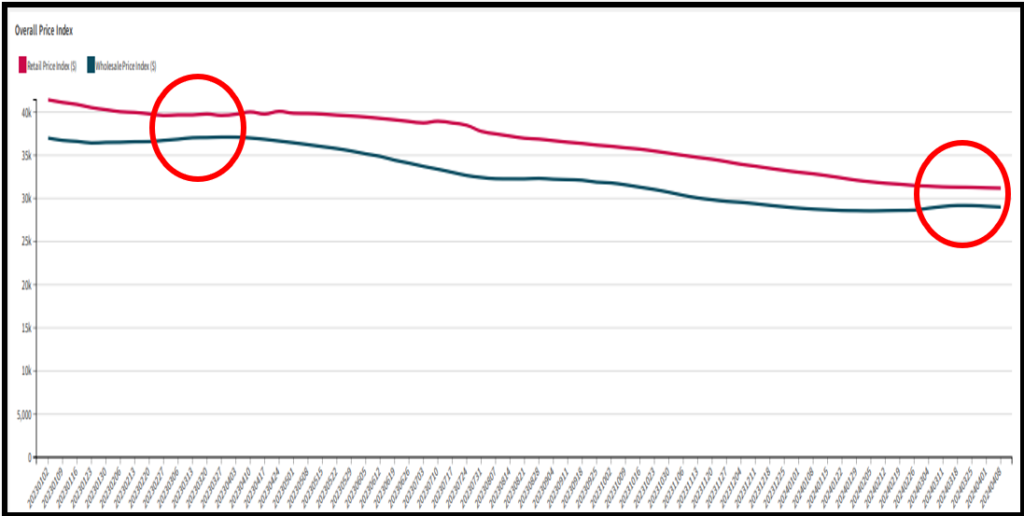

Retail Margin Trending

The market is trending toward the softening of margin compression as we have seen year over year a this time of the year as show by the red circle to the left.

Summary: Source

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

Turning inventory is the key to profitability in this market and taking advantage of market knowledge and trends is what is separating the profitable dealers.