Economic Automotive Outlook: Source

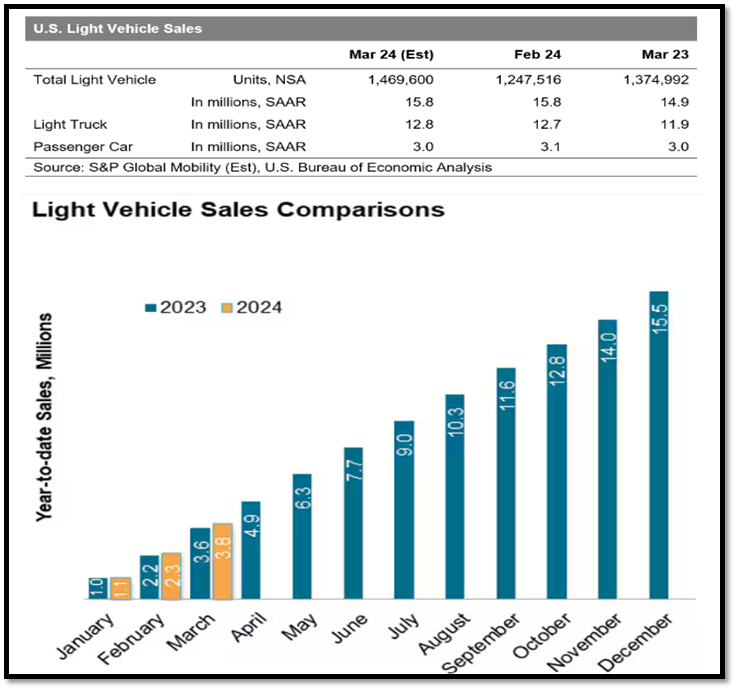

The S&P Global Mobility US auto outlook for 2024 reflects sustained, but more moderate growth levels for light vehicle sales. Production levels are expected to continue to develop, especially early in the year as some automakers look to continue to restock in the wake of production shutdowns late in 2023 and decent December 2023 sales volume.

- US. light vehicle sales tracked 15.4 million (annualized) units in the first quarter of 2024, 2.7% above the year-ago level.

- North American automotive production rose 9.6% year-on-year in 2023 and is expected to converge to the lower end of the pre-pandemic range next year.

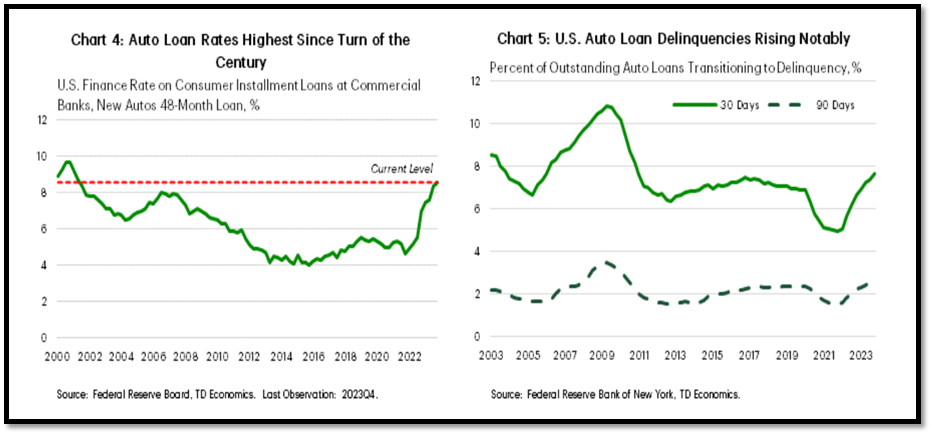

- Sales are expected to continue to rise but remain below the pre-pandemic pace as elevated financing costs continue to restrain sales activity.

Cox Automotive’s Manheim Wholesales Market Source

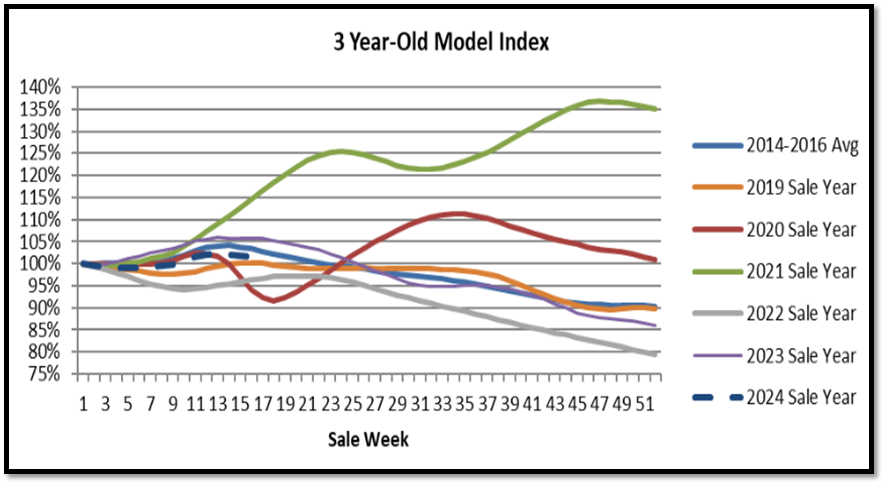

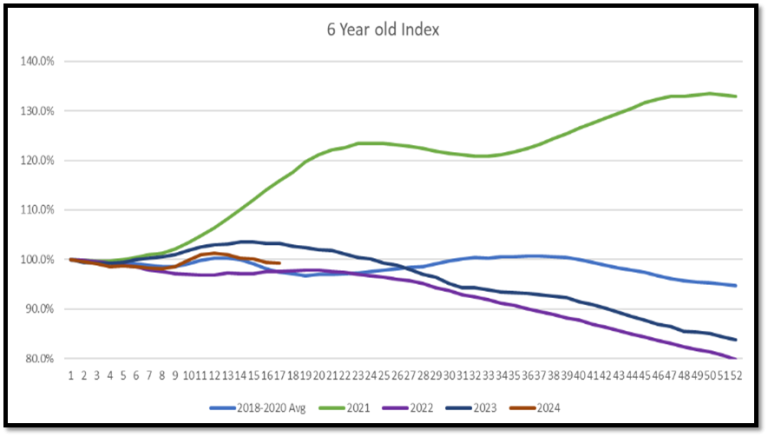

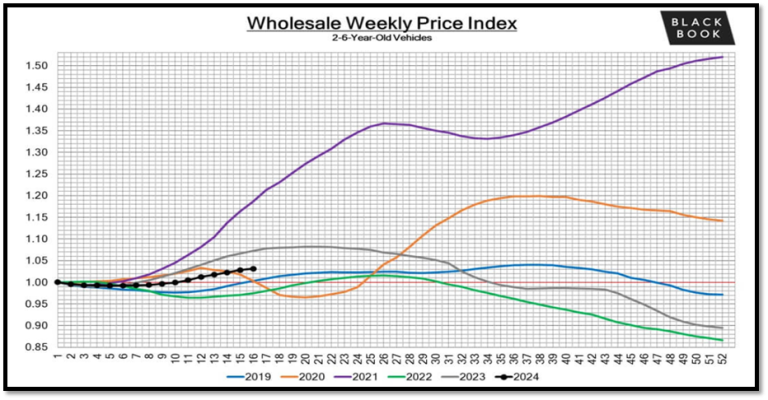

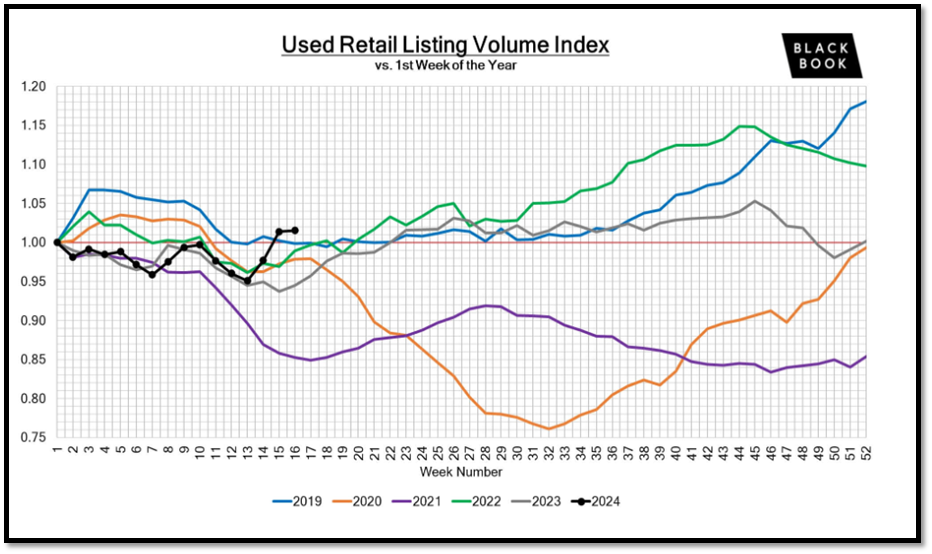

The Spring wholesale market continues to soften, particularly for older model year vehicles. On a positive note, both the used and new retail sales rate moved back closer to 2019 levels.

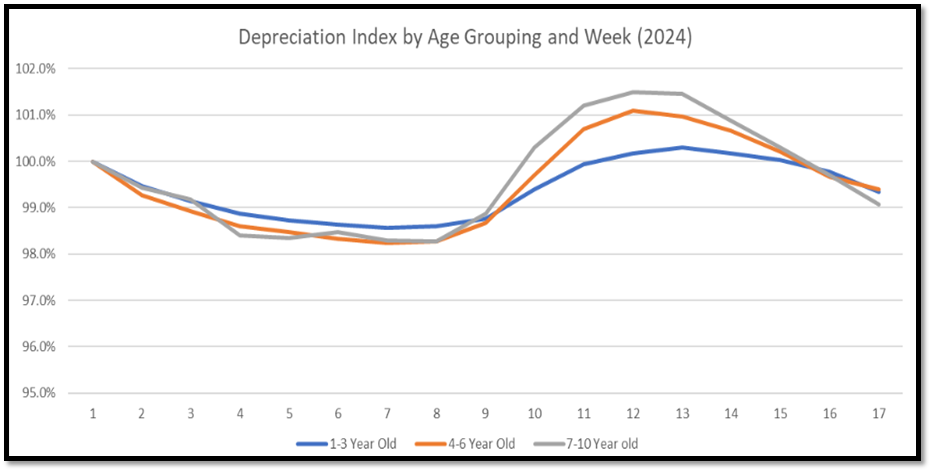

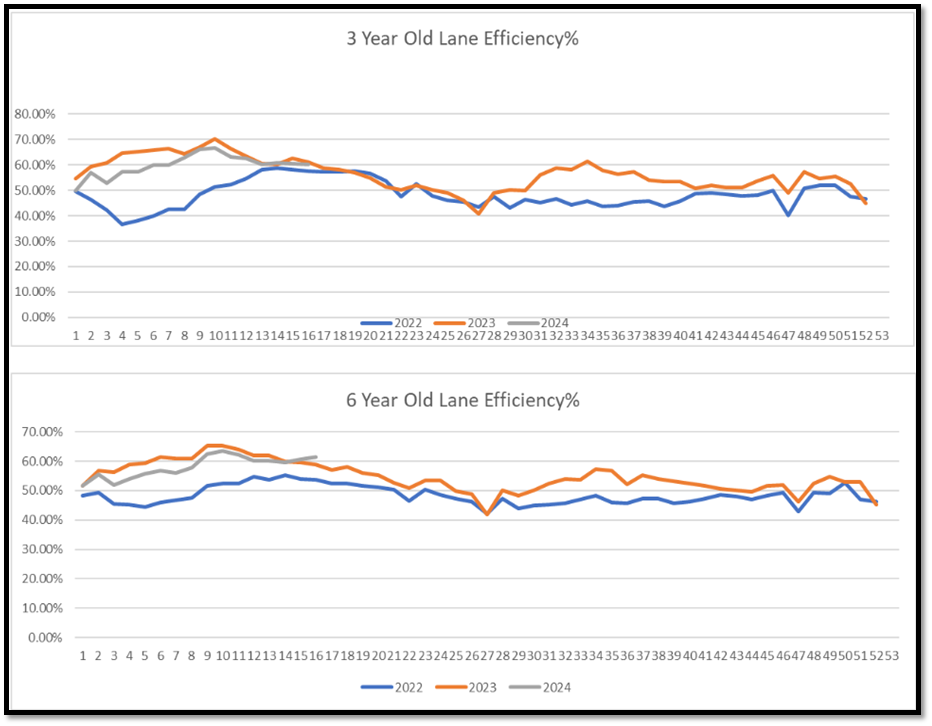

- Depreciation accelerated this week, with the 3-year-old index dropping 0.6% to 100.9%. Non-luxury down 0.6% and luxury down 0.5%.

- Wholesale value depreciation accelerated for most model years, particularly older model years with the sale prices below MMR (-1.19%) and lane efficiency generally plateauing.

Black Book: Source

- Signs of a spring market slowdown are emerging, as the overall market appreciated barely +0.05% last week, and the Trucks & SUVs category saw a slight -0.02% dip.

- Additionally, the average auction conversion rate nationwide experienced a minor decrease, indicating that buyers are starting to proceed with more caution.

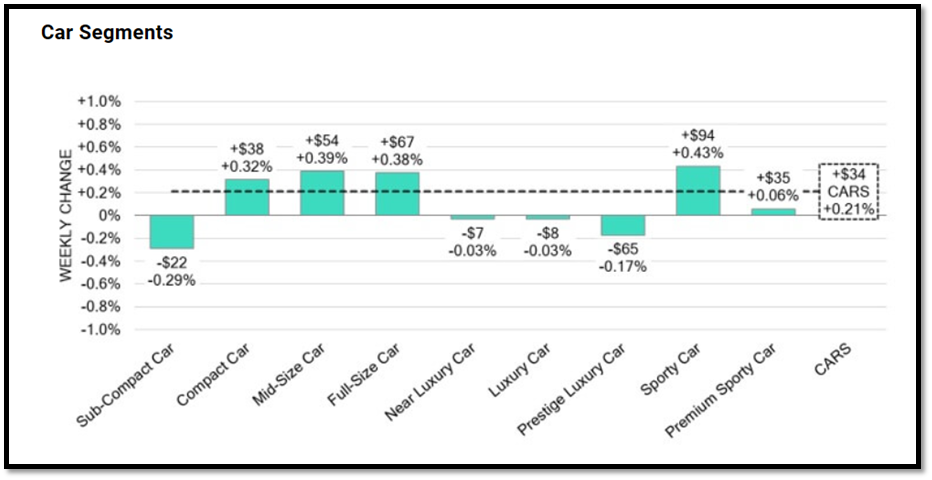

- On a volume-weighted basis, the overall Car segment increased +0.21%. For reference, in the previous week, cars increased +0.27%.

- The volume-weighted, overall Truck segment decreased -0.02% compared to the appreciation seen the prior week of +0.09%.

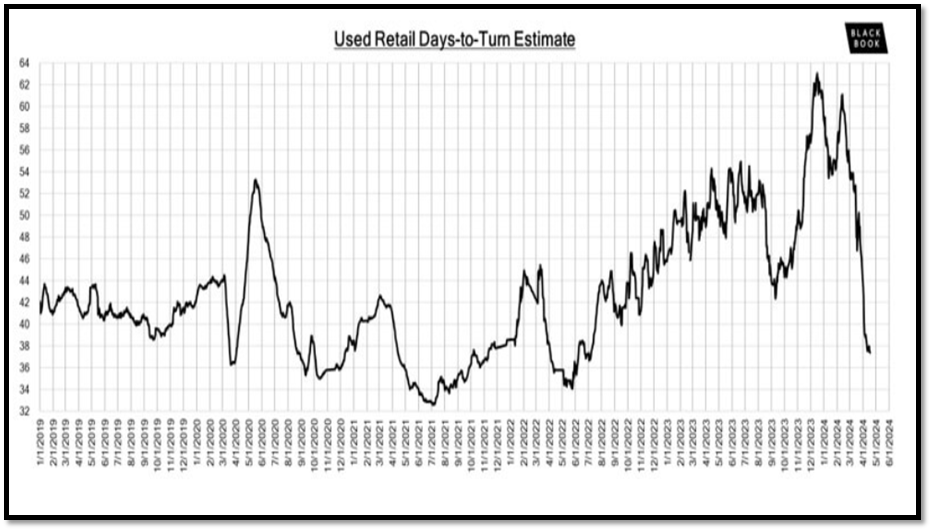

- The Used Retail Days-to-Turn estimate is now sitting around 37 days.

- Last week, the conversion rate saw a slight decline to 57%, with buyers demonstrating more caution in light of indications that the spring market is beginning to slow down.

- On a volume-weighted basis, the overall Car segment increased +0.21%. For reference, in the previous week, cars increased +0.27%.

- The 0-to-2-year-old Car segments were up +0.06% and 8-to-16-year-old Cars increased +0.21%.

- Five of the nine Car segments increased last week.

- While the growth rate is beginning to decelerate for the overall market, the Compact Car segment is still on an upward trajectory, marking gains for the 15th straight week. It saw an increase of +0.32% last week.

- The volume-weighted, overall Truck segment decreased -0.02% compared to the appreciation seen the prior week of +0.09%.

- The 0-to-2-year-old models gained +0.03% on average and the 8-to-16-year-olds decreased by -0.09% on average.

- Six of the thirteen Truck segments increased last week.

- Full-Size Vans are experiencing an accelerated pace in depreciation, with a decline of -1.67% last week. This uptick in supply, propelled by a rise in fleet remarketing, is driving the depreciation.

- The Small Pickup segment maintains its strong performance, recording a +0.42% gain last week. This marks the ninth consecutive week of upward movement, with a weekly average increase sitting at +0.32%.

Retail Trending: Source

The falling new vehicle prices and higher incentives have helped to push down the average monthly payment for new vehicles to roughly $750 at the start of 2024. This is down from the peak of nearly $800 in late 2022, but still about 50% above the amount paid in 2019.

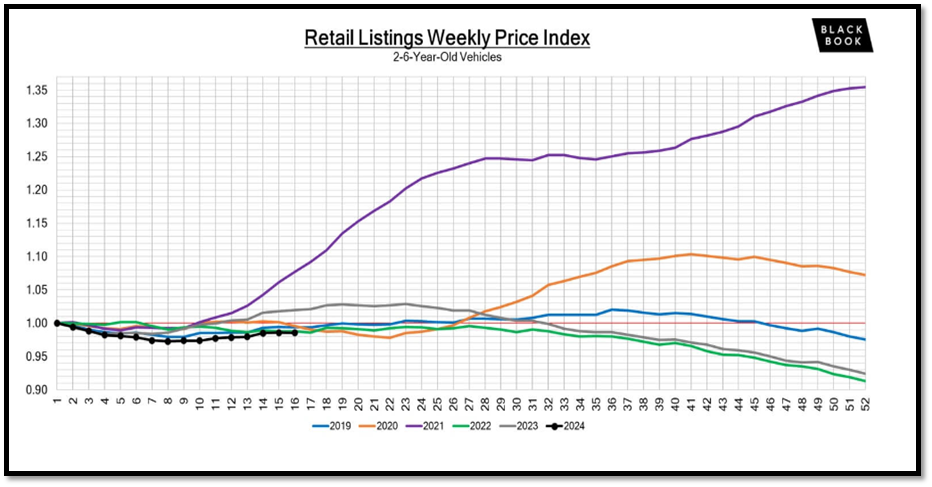

- Retail prices declined 0.2% for non-luxury and 0.5% for luxury. Six-week lagged spreads continue to drop due to increasing wholesale values several weeks back compared to flat or decreasing retail values. As wholesale value depreciation accelerates, non-luxury spreads will begin to increase soon.

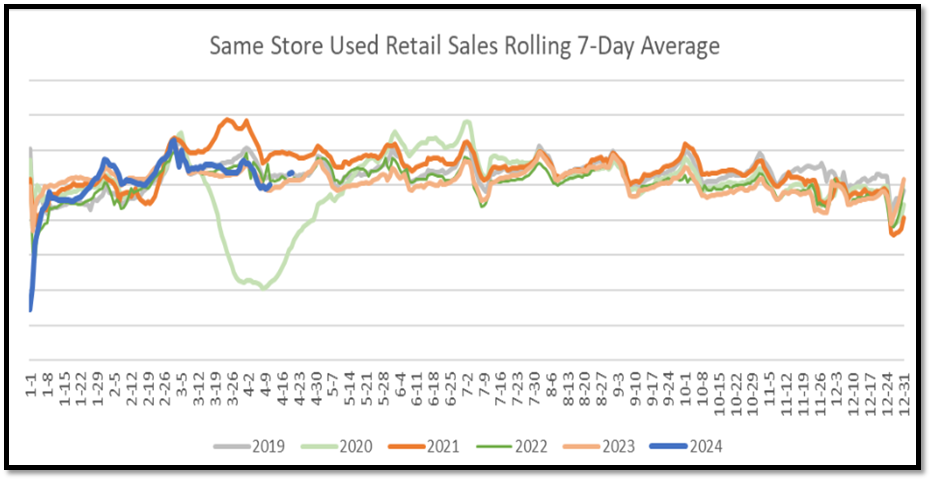

- The used retail sales rate is trending similar to most previous years and days’ supply at 41 days.

- New car sales trending close to 2019 levels and days’ supply moved down to 72 days.

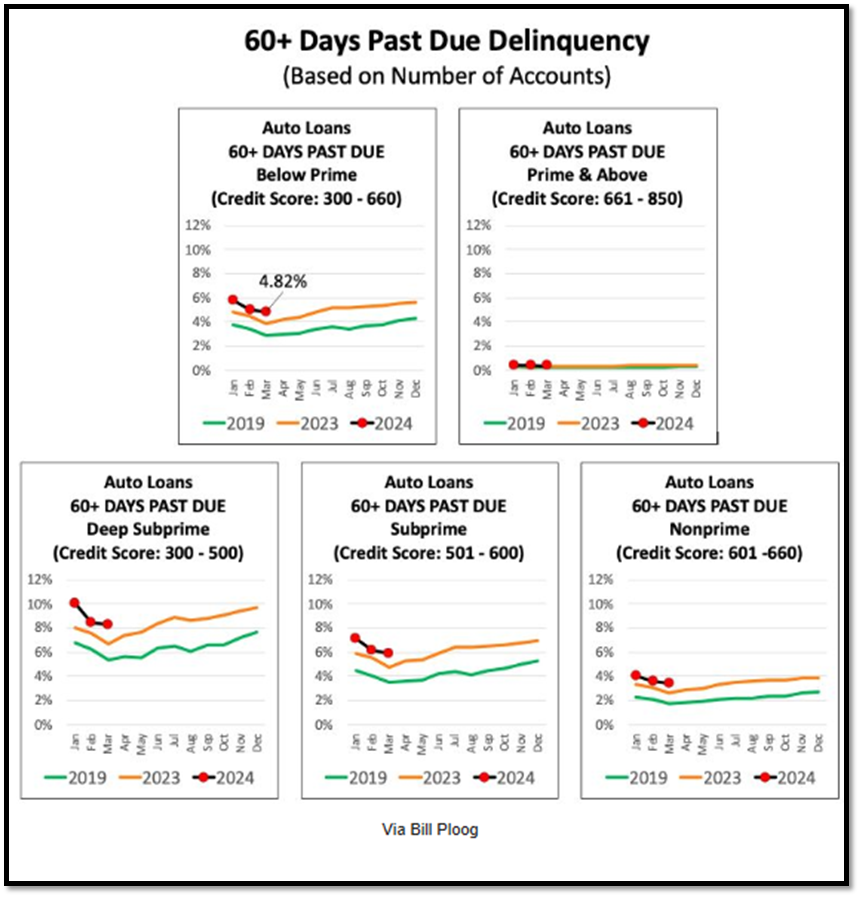

Finance Market Update: Source

- Cash transactions are on the rise, and that’s led to 1.2 million fewer financed transactions.

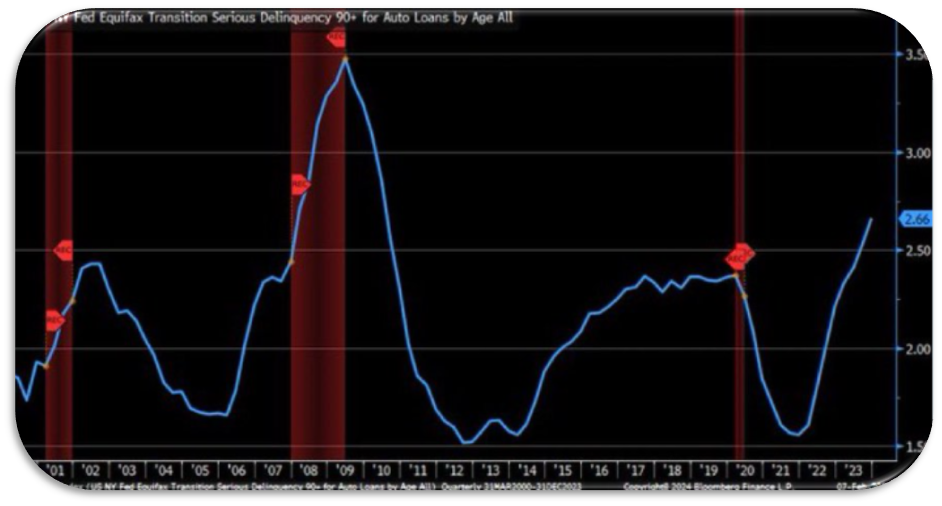

- The average loan rate was 6.92% for new cars and 11.59% for used cars in 2023. And those higher rates have led to more defaults (see above, right?).

- The median credit score for auto finance has inched higher lately, but that hasn’t stopped delinquencies (especially among Gen Y and Gen Z buyers).

- Repossessions are increasing. Near-prime repossessions have doubled as a percentage of all repo balances since 2019.

Summary: Source

- Used car prices rose slightly in March but remain 4% lower than they were a year ago.

- The average listed price for a used car at the end of March was $25,540.

- Interest rates are falling slowly, and significant improvements are likely later in 20241.

- Edmunds reports a 5.5% year-over-year drop in used-vehicle average transaction prices, indicating market stability.

- Near-new used cars are transacting at prices notably below brand-new cars, and new-car discounting is affecting used cars of all ages.

In summary, if you’re in the market for a car, now might be a good time to explore both new and used options. Keep an eye on prices and incentives and consider waiting if you can take advantage of potential further price drops.