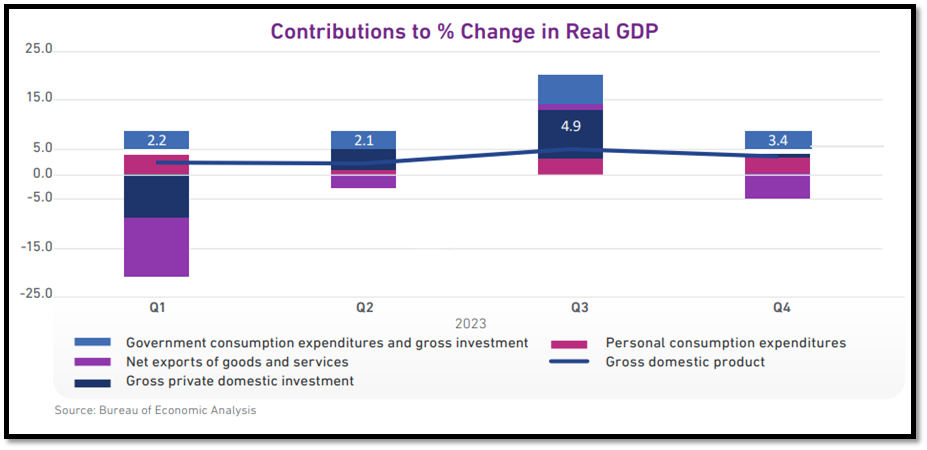

Economic Automotive Outlook: Source (Interest Rate Projections)

- Economic growth is expected to slow towards the end of 2024 from the combination of stubborn core inflation, higher interest rates, tighter lending standards, and increased uncertainty.

- Consumer spending will be squeezed as savings accumulated during the pandemic are depleted, however strong confidence will partially offset this.

- Experian projects CPI inflation will continue to ease over the coming quarters but will remain above the Fed’s target of 2% until early 2025 with the unemployment rate edging up to 4% in 2024 as post-pandemic ultra tightness fades.

Tax season is catching up to prior years in the volume of returns and the end of the season is near.

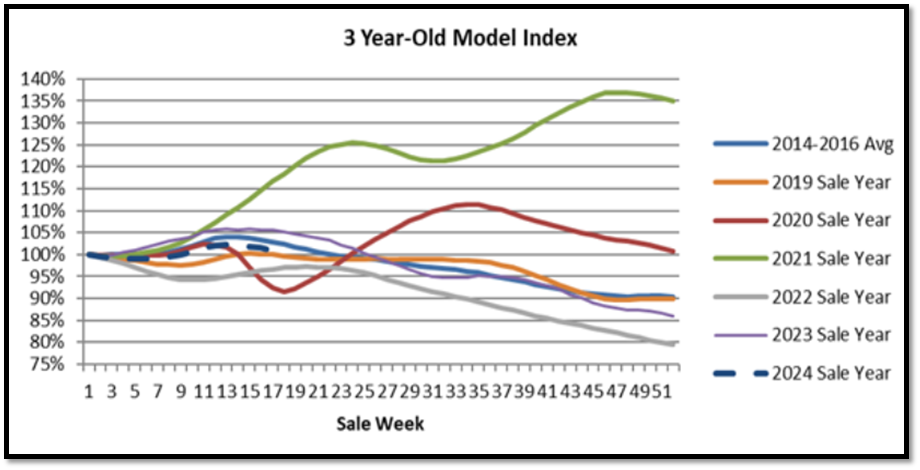

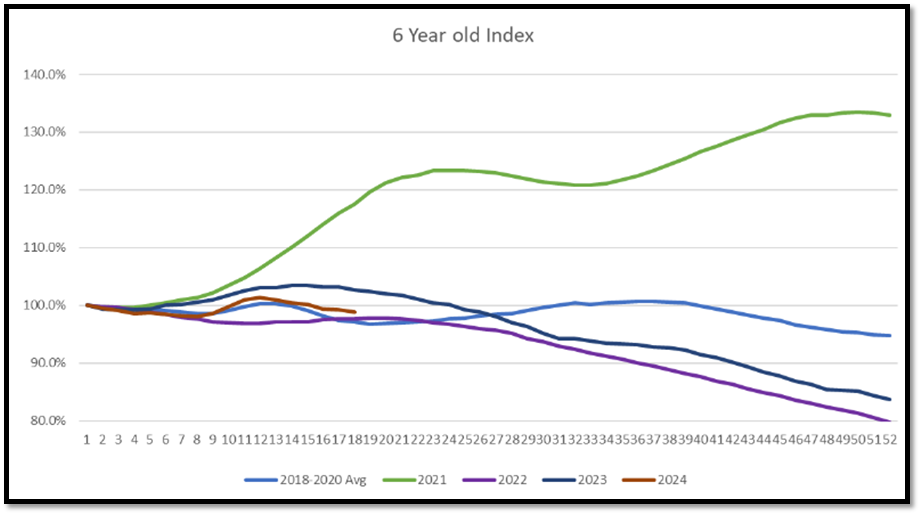

Cox Automotive’s Manheim Wholesales Market Source

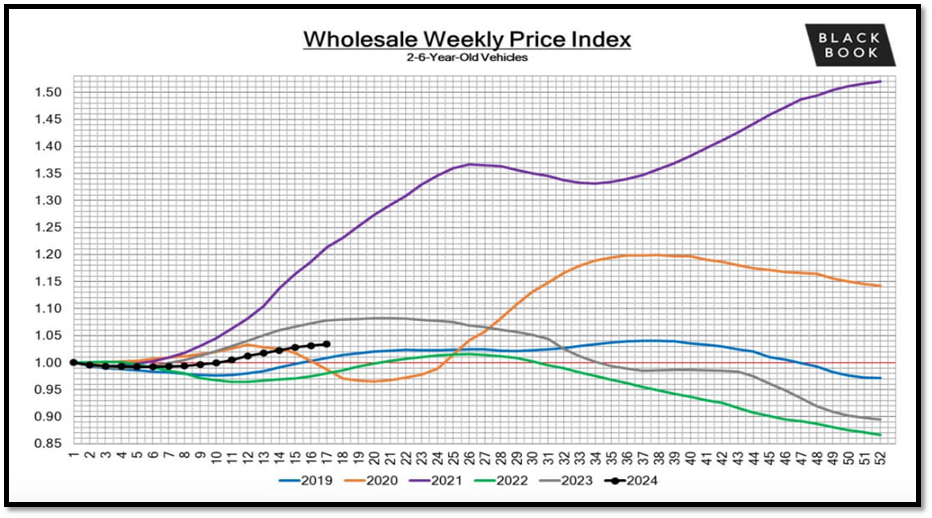

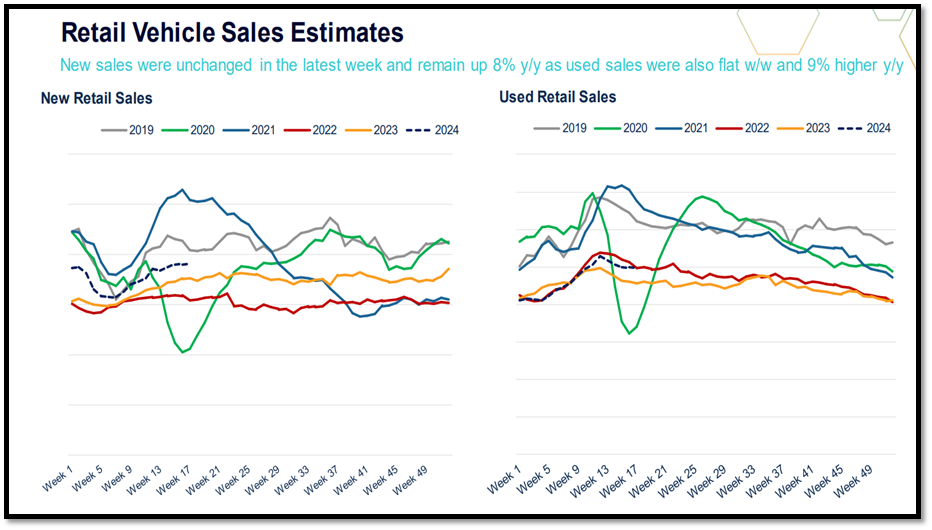

Little change from last week’s trends. The Spring wholesale market continues to soften. Used and new retail sales continue to trend close to 2019 levels and days’ supply drifting down at the end of the month.

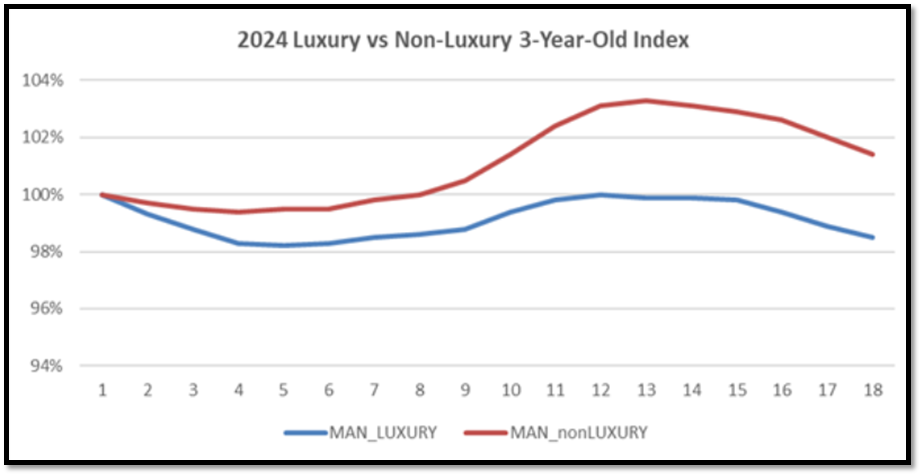

- The 3-year-old index depreciated 0.5% to 100.4%. Non-luxury was down 0.6% and luxury was down 0.4%.

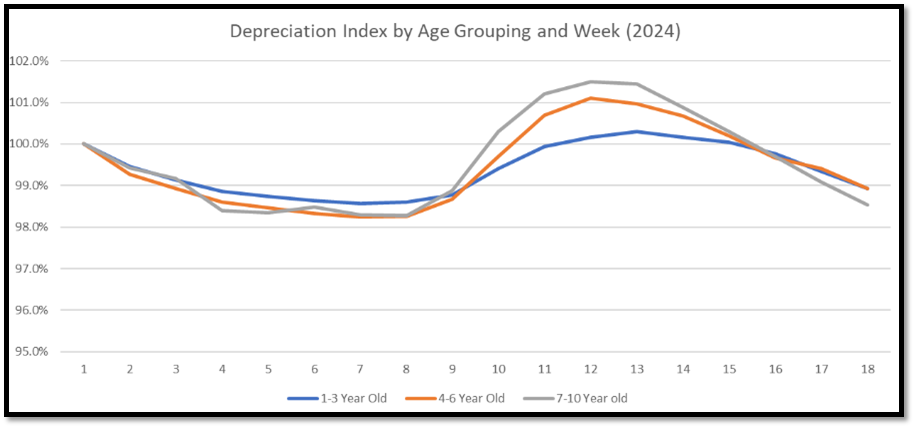

- Wholesale values depreciated for all model years.

- Sale prices below MMR (-1.48%).

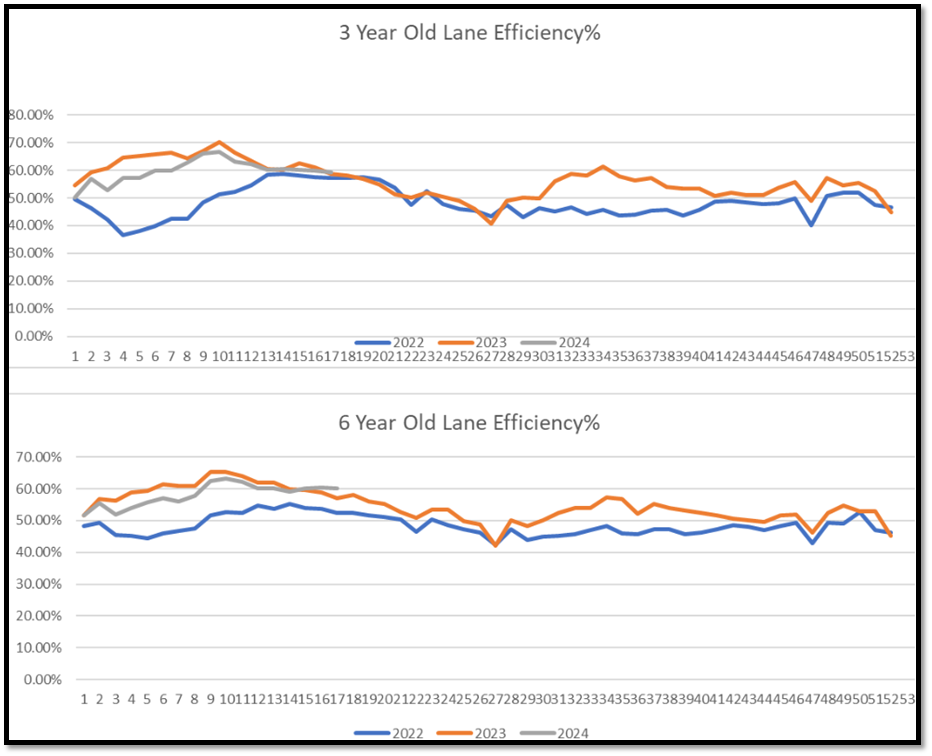

- Lane efficiency is generally plateauing.

Black Book: Source

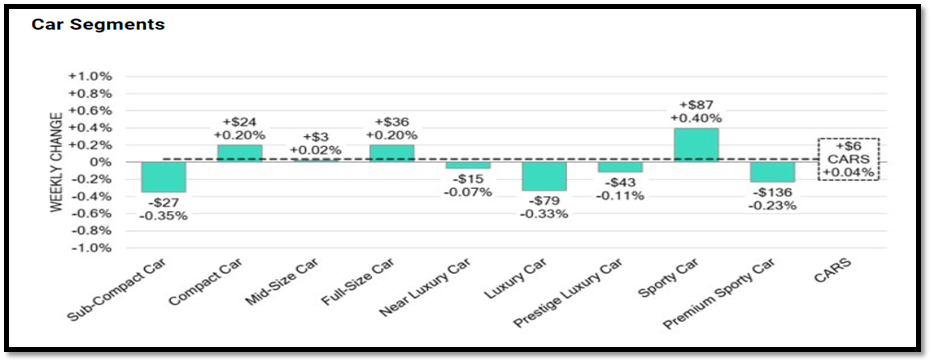

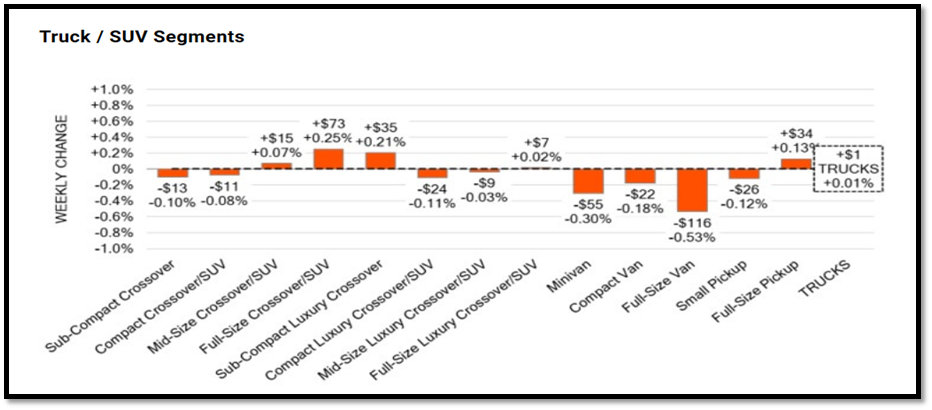

Last week, the wholesale market showed steadiness, with minimal fluctuations in both the car and truck categories. Notable exceptions included the luxury car and sub-compact vehicle segments, which faced declines. Full-size vans, in particular, continued to show the largest decreases of all segments.

The auction conversion rate, which indicates the percentage of vehicles sold at auctions, remained steady at 57%, unchanged from the previous week. As always, our team of analyst are focused on keeping their eyes on the market for developing trends and gathering insight.

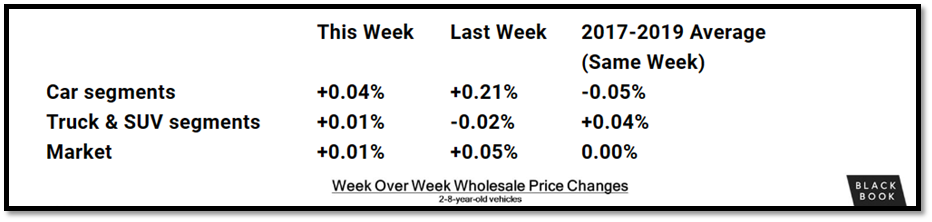

- On a volume-weighted basis, the overall Car segment increased +0.04%. For reference, in the previous week, cars increased +0.21%.

- The 0-to-2-year-old Car segments were down -0.06% and 8-to-16-year-old Cars increased +0.15%.

- Four of the nine Car segments increased last week.

- The volume-weighted, overall Truck segment increased +0.01% compared to the depreciation seen the prior week of -0.02%.

- The 0-to-2-year-old models gained +0.01% on average and the 8-to-16-year-olds decreased by -0.14% on average.

- Five of the thirteen Truck segments increased last week.

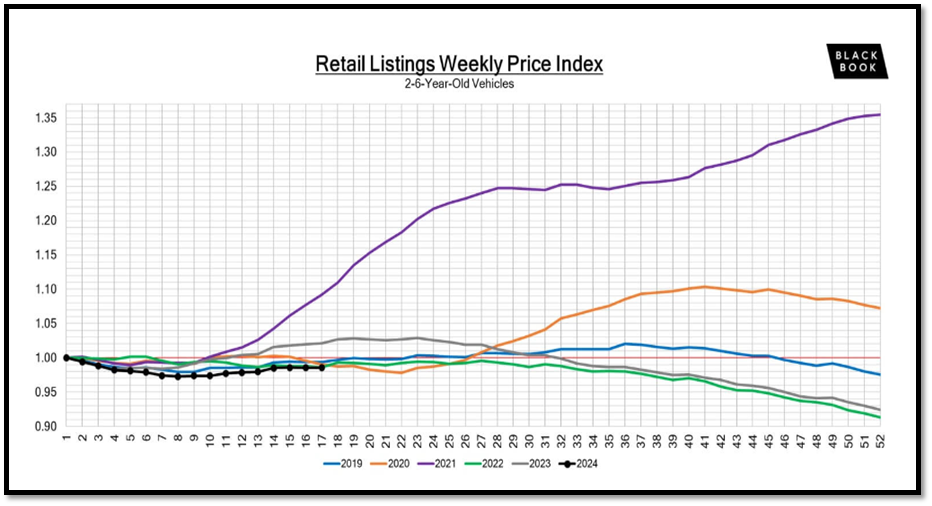

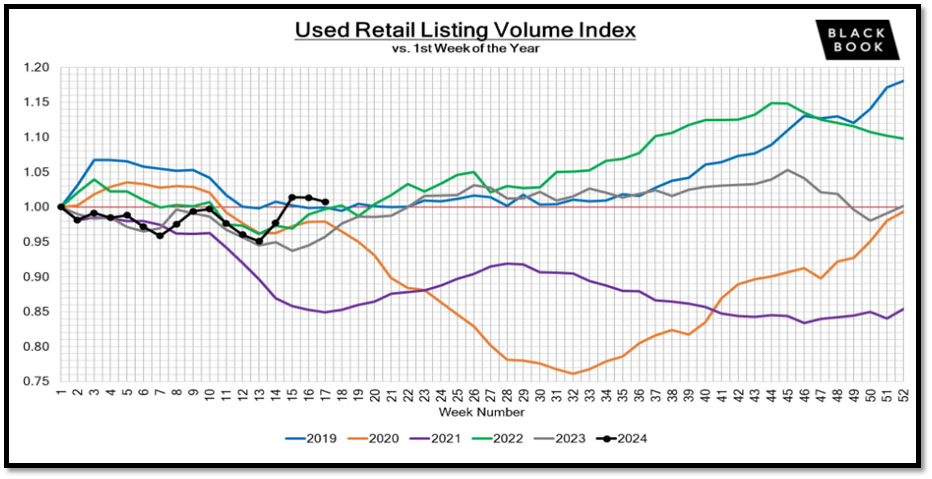

Retail Trending: Source

- Retail prices declined 0.1% for non-luxury and 0.4% for luxury. Six-week lagged spreads continue to drop due to increasing wholesale values several weeks back compared to flat or decreasing retail values. As wholesale value depreciation accelerates, non-luxury spreads will begin to increase soon.

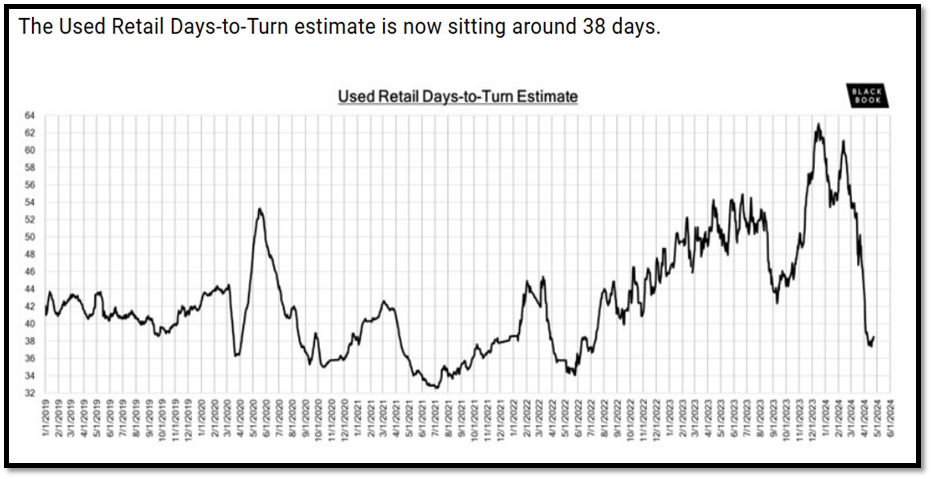

- The used retail sales rate is trending similar to most previous years; days’ supply at 40 days.

- New car sales trending close to 2019 levels and days’ supply moved down to 66 days.

Summary: Source

The current sales environment for new and used vehicles has improved over the last quarter but remains lower year over year. The new-vehicles sales index improved 1 point to 52, down from 57 one year ago. Likewise, the used-vehicle sales index increased 1 point to 40, but it is down from 44 a year ago and well below the long-term index average of 50. For franchised dealers, the used-vehicle sales index held steady near a record low of 51 in Q1. For independent dealers, the used-vehicle sales index increased by 1 point but remains well below longer-term averages. That suggests becoming exceptional used car operations will help grow market share for franchise operations.