Economic Outlook: Source

Jobless claims so far this year are not showing any substantial change in trend, reflecting limited stress in the labor market.

Tax refund season is underway and already running seven processing days behind last year. Through last week 25% fewer refunds have been issued with the average refund showing an increase of 2% at $3,207.

The Fed remains patient on cutting rate policy, and their rhetoric has forced financial markets to adjust rate cut expectations to match their projections. Rates have moved higher in 2024 and sit near 23-year highs.

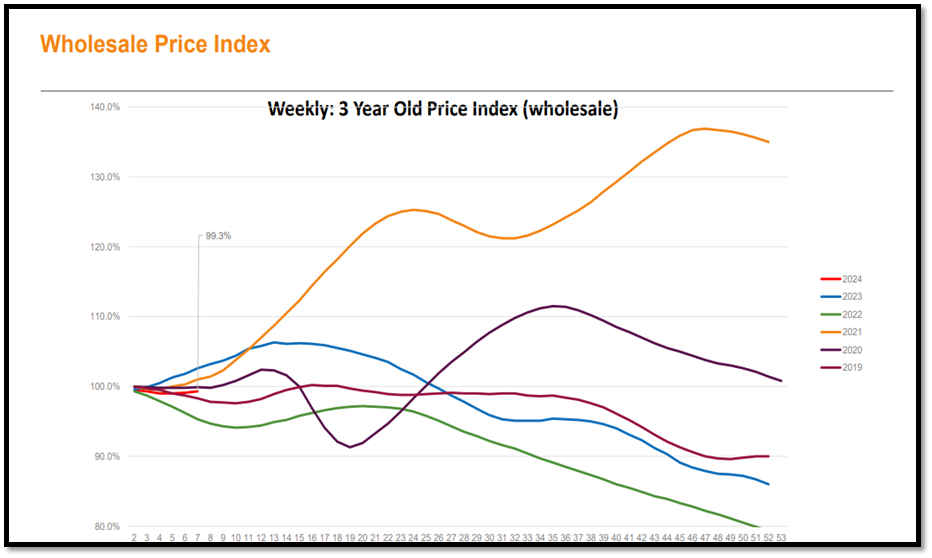

Manheim Wholesales Market Source

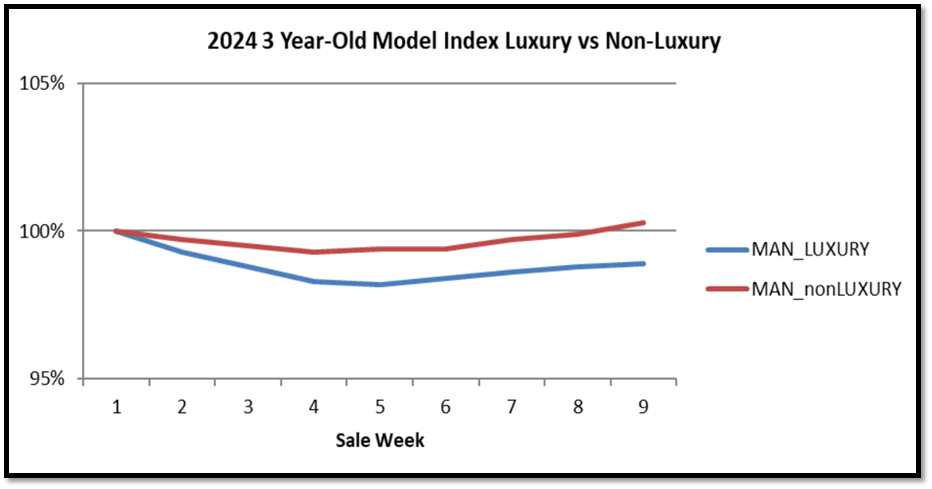

More signs of a Spring market arrived this week. Three-year-old wholesale values increased 0.3% (all-age vehicles increased week over week), lane efficiency increased 3.0% pts, and sale prices moved closer to MMR. Used retail sales are still strong compared to most previous years and days’ supply is lower than average. New car days’ supply generally increases as inventory grows.

- Week over week three-year-old values increased 0.3%. Luxury increased 0.1% and non-luxury increased 0.4%.

- Wholesale values increased for all ages of vehicles; older model years increased the most.

- Sale prices moving closer to MMR (-0.42%).

- Lane efficiency increased ~3% pts weekly and ran close to 2023 levels.

- Retail prices dropped some last week, and spreads continue to drop due to stabilizing wholesale values and dropping retail prices.

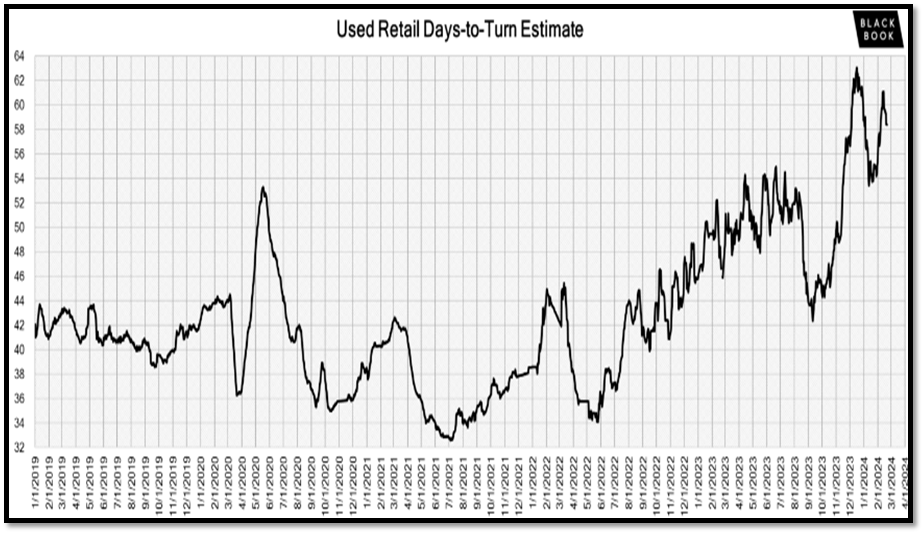

- Despite low inventory, used retail sales continue at a strong pace. Days’ supply dropped to 37.

- New car sales continue to trend higher than some previous years, but inventory also continues to build. Days dropped to 68.

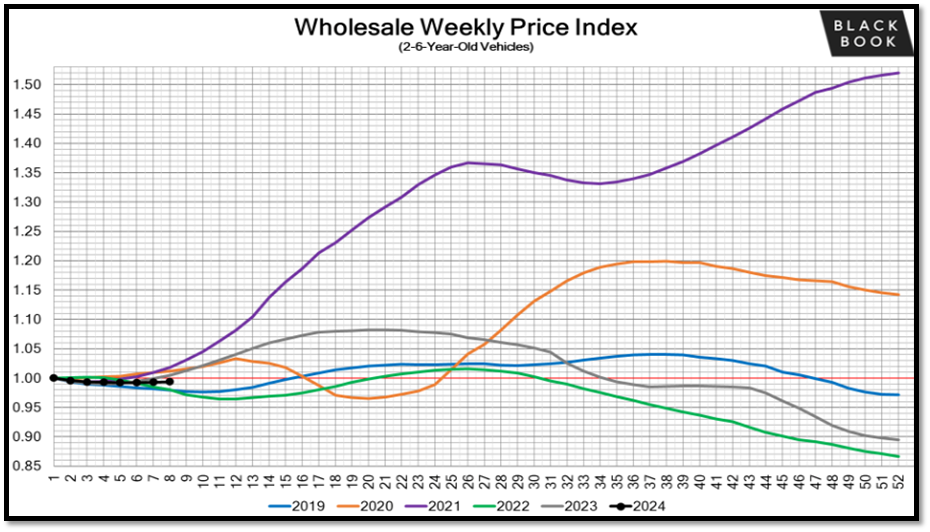

Black Book: Source

- On a volume-weighted basis, the overall Car segment decreased -0.25%. For reference, in the previous week, cars decreased by -0.17%.

- The 0-to-2-year-old Car segments were down -0.19% and 8-to-16-year-old Cars declined -0.22%.

- Two of the nine Car segments increased last week.

- The Compact Car segment saw its value rise for the seventh consecutive week, with a modest gain of +0.04% last week. This uptick marks a deceleration in growth compared to the previous four weeks, which averaged a more robust +0.18% weekly increase.

- The Near Luxury Car segment experienced the most substantial decrease, with a decline of -0.86%. This represents the biggest one-week drop for the segment since December 2023.

- While the Sub-Compact Car segment for vehicles aged 2 to 8 years continues to experience a decline, models in the older 8 to 16 years range have seen an upward trend over the past three weeks. Last week, this segment saw an increase of +0.26%.

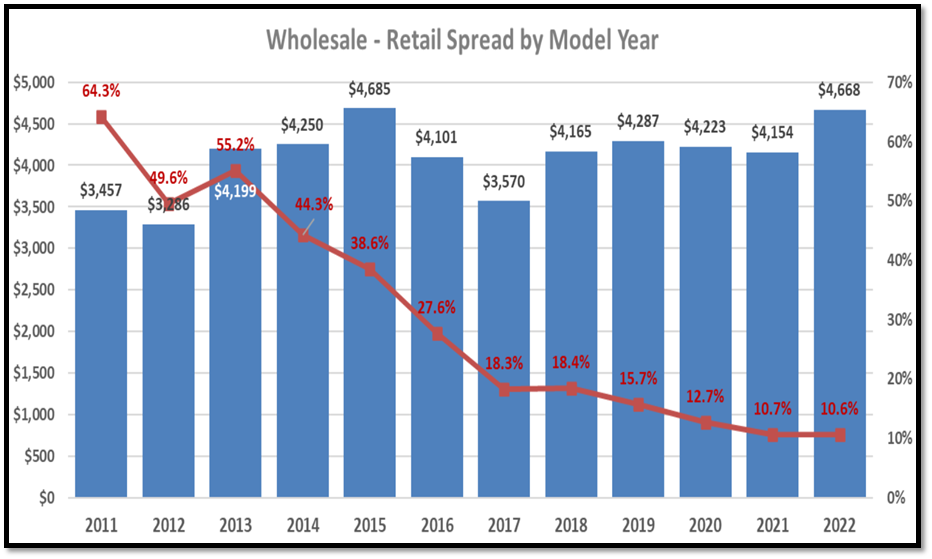

Manheim Wholesales to Retail Trending: Source

- The average spread is consistent for most model years, and both the $ value spread and % spread are slightly smaller than last week as retail prices have been declining.

- The 1-year-old (2022 MY) % spread decreased by 0.10% from 10.72% last week to 10.62% this week.

- The 3-year-old (2020 MY) % spread decreased by 2.12% from 14.86% last week to 12.74% this week. This is the biggest weekly decrease for a 3-year-old.

- The 5-Year-Old (2018 MY) % spread decreased by 0.62% from 19.00% last week to 18.38% this week.

- Total average % spread decreased by 0.78% from 20.37% last week to 19.59% this week.

Black Book: Source

Vehicle Valuations: Source

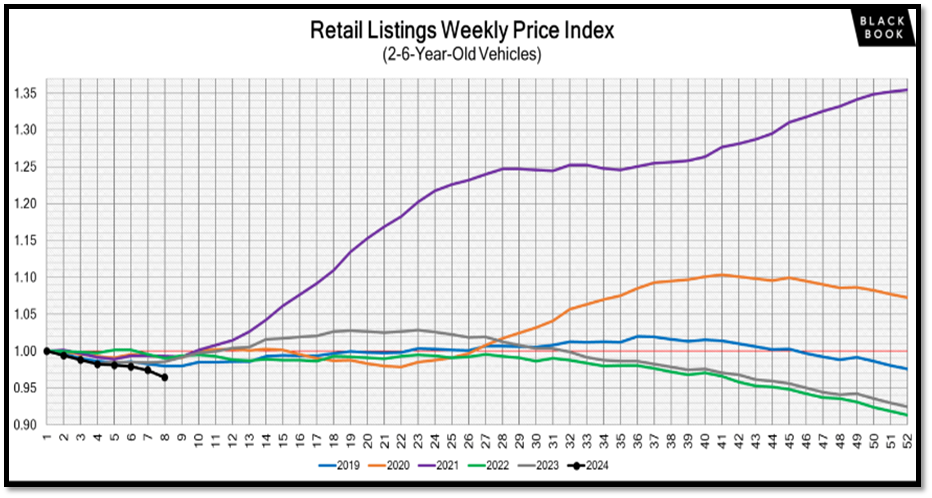

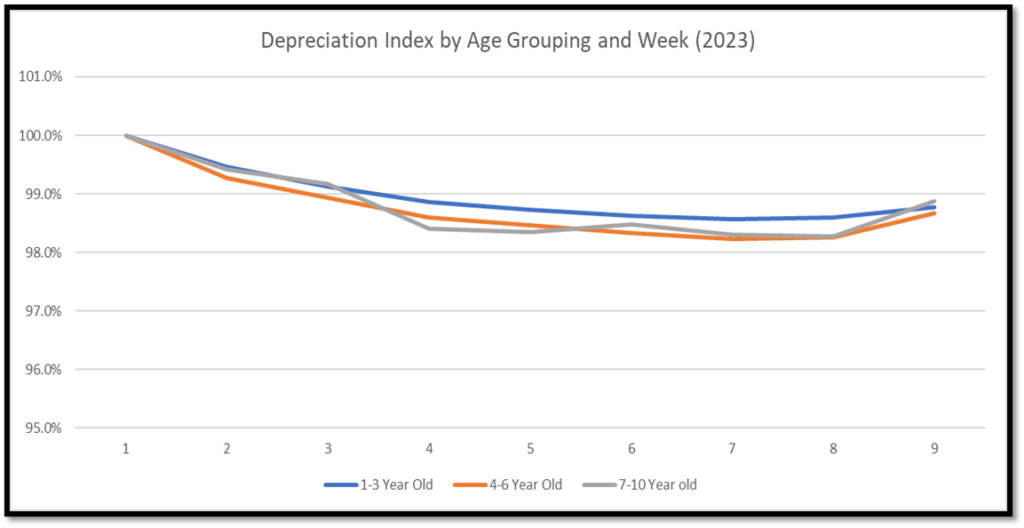

We are once again in an appreciation market and will be for some time. Looking below from top to bottom, all years are seeing an increase in acquisition cost with the most expensive hard to sell late model used inventory increasing the least show in the top two graphs specifically. The reason is consumer affordability.

Summary: Source

The Automotive Advisor Team’s research shows that affordability is the number one driving factor in consumers’ decision to purchase during this tax season, leading into the spring bounce. With the value of vehicles purchased by automotive dealers growing week over week in this current market, having an aggressive approach to finding and paying for the inventory you know turns quickly is critical.

Our used car optimizer program gives used car managers and general managers the courage to be aggressive when the market demands it and know when to pull back on the accelerator when the market is about to shift. Reach out to our team today at info@theautomotiveadvisorteam.com for a free consultation.