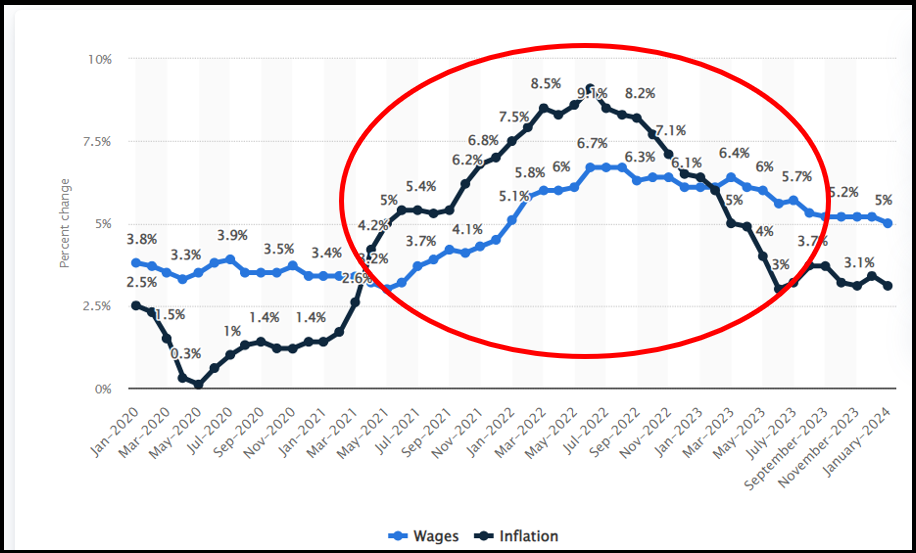

Economic Outlook: Source

We could be in for a nice tax season. According to the Bureau of Labor Statistics, the median worker experienced a 5.5% increase in earnings during 2023. However, this growth falls short of the 7.1% inflation adjustment implemented by the Internal Revenue Service (IRS) for various tax provisions last year. The IRS annually adjusts more than 60 tax provisions, including tax rate schedules and other tax changes2. Here are some key highlights from the adjustments for tax year 2023:

- Standard Deduction:

- For married couples filing jointly, the standard deduction rose to $27,700, an increase of $1,800 from the previous year.

- Single taxpayers and married individuals filing separately saw the standard deduction rise to $13,850, up by $900.

- Heads of households now have a standard deduction of $20,800 for the tax year 2023, an increase of $1,400 compared to 20222.

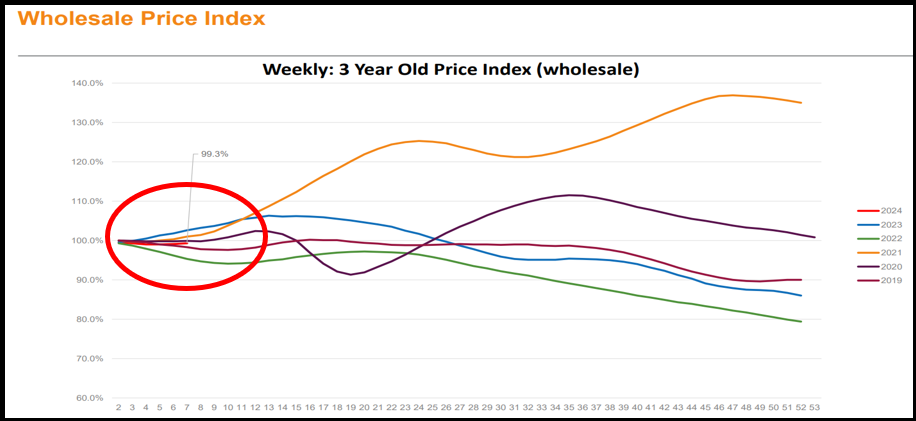

Wholesales to Retail Trending: Source

- The wholesale value continued to decline for all model years at a similar pace from last week.

- The average spread is consistent for most model years, and both the $ value spread and % spread are slightly higher than last week.

- The 1-year-old (2022 MY) % spread decreased by 0.34% from 11.40% last week to 11.06% this week. This is the second week that the value decrease was under $100 since we started to report the numbers last July.

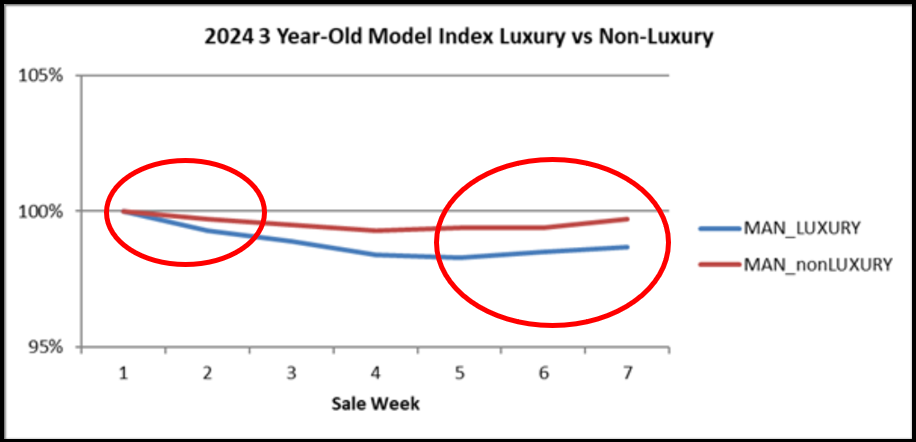

Manheim: Source

The 2022 May retail value increased by $227.

- The 3-year-old (2020 MY) % spread increased by 0.15% from 13.75% last week to 13.90% this week.

- The total average % spread increased slightly last week by .11%.

- Week-over-week values increased 0.2%. Luxury increased 0.2% and non-luxury increased 0.3%.

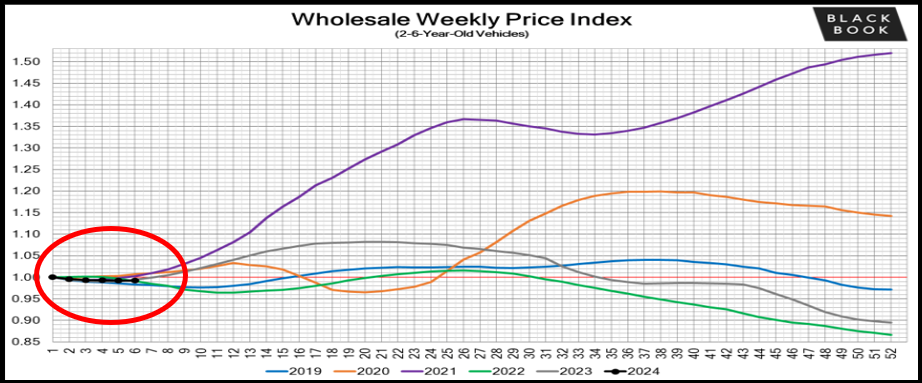

Black Book: Source

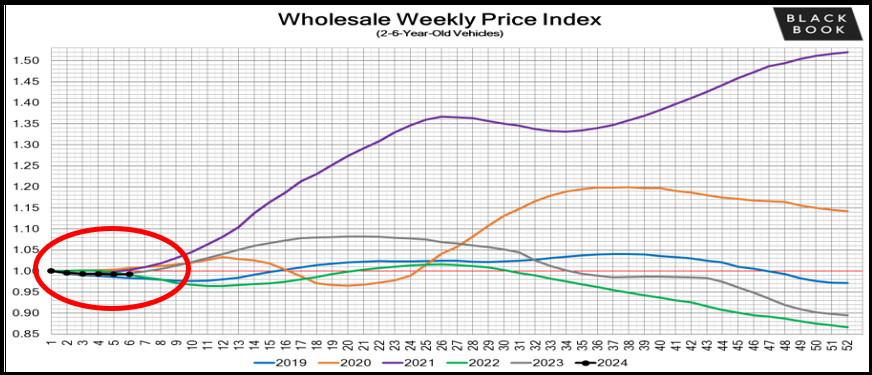

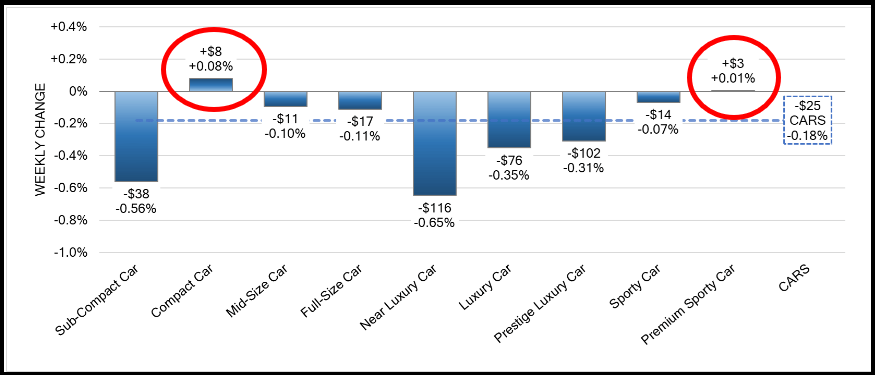

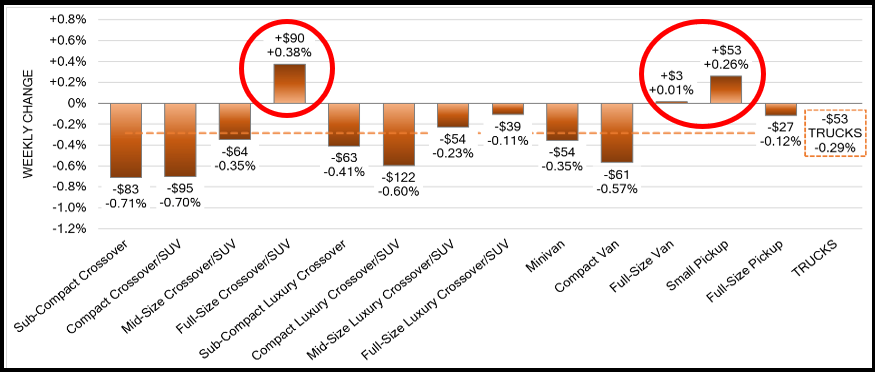

The initial week of February maintained the stability of the wholesale market seen at the end of January. There was a modest rise in auction inventory alongside value stabilization within both car and truck categories. Over the past four weeks, the market has shown gradual improvement, with no significant fluctuations but rather minor price upticks in certain car and truck segments.

- On a volume-weighted basis, the overall Car segment decreased -0.18%. For reference, in the previous week, cars decreased by -0.22%.

- The 0-to-2-year-old Car segments were down -0.02% and 8-to-16-year-old Cars declined -0.11%.

- The 0-to-2-year-old models declined -0.25% on average and the 8-to-16-year-olds decreased by -0.05% on average.

- Three of the thirteen Truck segments increased last week.

- The Full-Size Crossover/SUV segment increased the rate of gain last week, up +0.38%, compared with +0.03% the week prior.

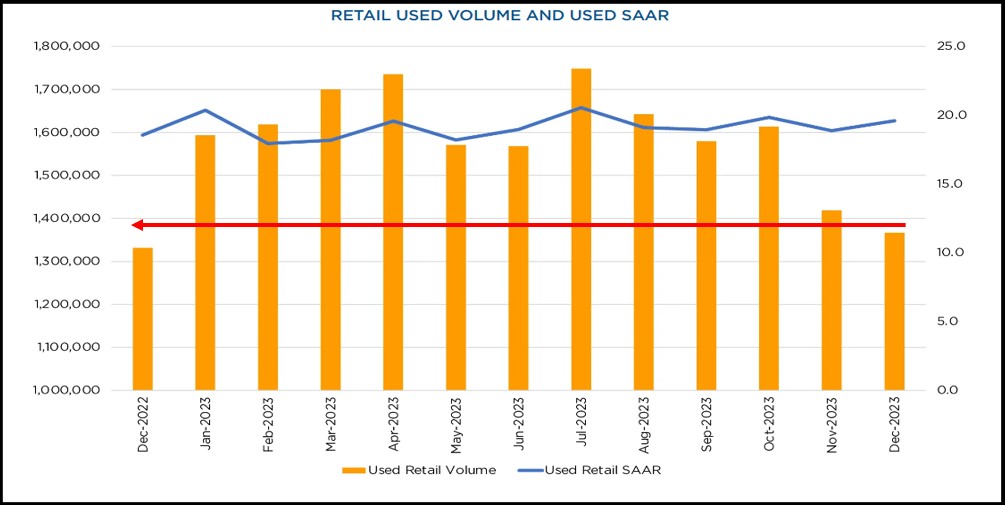

Retail Sales Market Outlook: Source

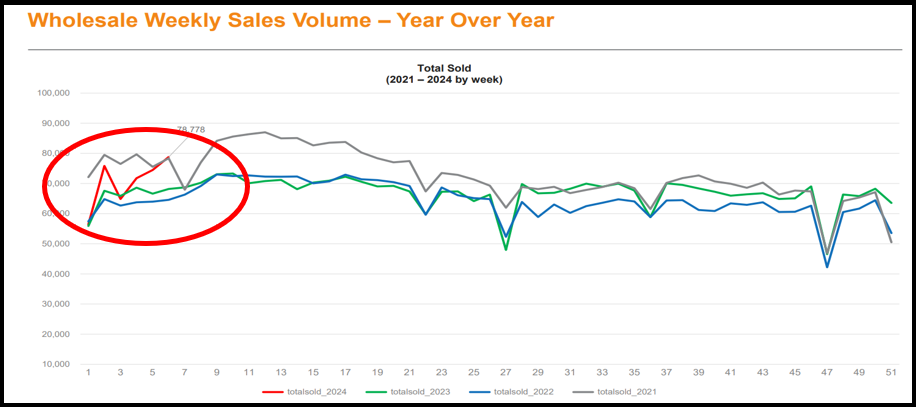

In November last year we saw an increase over November 2023 and last month December 2023 beat December 2022 in retail sales volume. That’s an indication that January through April could look much like we see below.

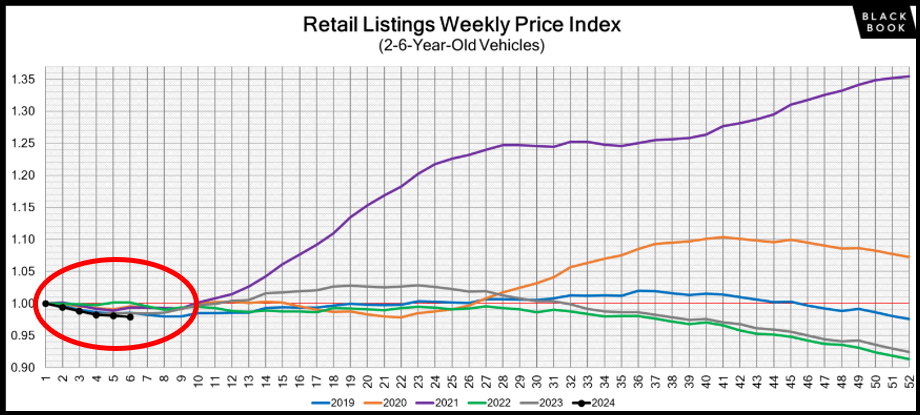

Retail Supply Market Outlook: Source

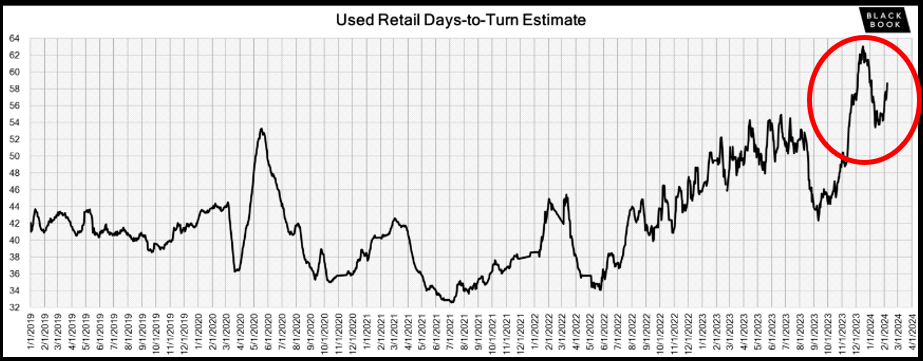

The market is showing signs of appreciation like we expected and should continue this trend through tax season, which impacts acquisition strategies as well as aging policies. More importantly, after a few weeks, we expect to see the retail price of used vehicles increase as it historically does.

Summary: Source

In contrast to high prices that auto dealers commanded over the past few years, taking advantage of strong demand for new vehicles and short supplies of popular models due to supply chain bottlenecks, discounts and incentives on new vehicles continue to rise, and that is putting downward pressure on pricing and profitability for dealers and automakers alike,” a Cox Automotive report showed on Tuesday.

Despite lower prices and higher incentives, U.S. new-vehicle sales pace slowed in the first month of the year, the report said. Auto loan delinquencies and defaults increased in January exasperating the problem.

However, Used-vehicle retail sales rose as prices held steady heading into tax season and with affordability driving demand, we expect that to continue at least through March.