Economic Outlook: Source

- The unemployment rate held steady at 3.7% while the labor force participation rate remained at 62.5% for a second consecutive month.

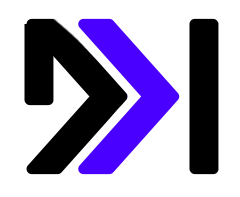

- Wage pressures strengthened with hourly earnings rising a hot 0.6% month over month, partly reflecting the pullback in hours worked. As a result, wage growth rose 0.2ppt to 4.5%, the highest since September 2023.

- This year, the US economy will likely experience below-trend but positive job growth with the unemployment rate likely to be in a slight uptrend but remain relatively low. We see the unemployment rate rising to 4.1% by year-end.

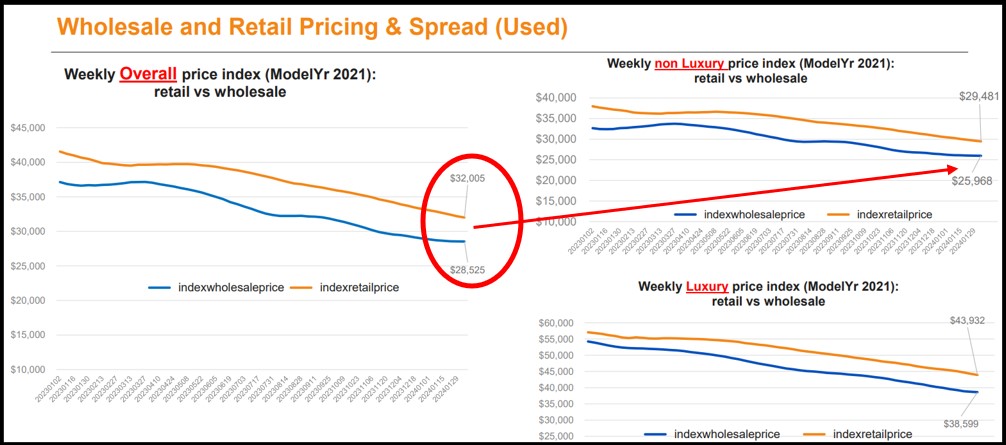

Wholesales to Retail Trending: Source

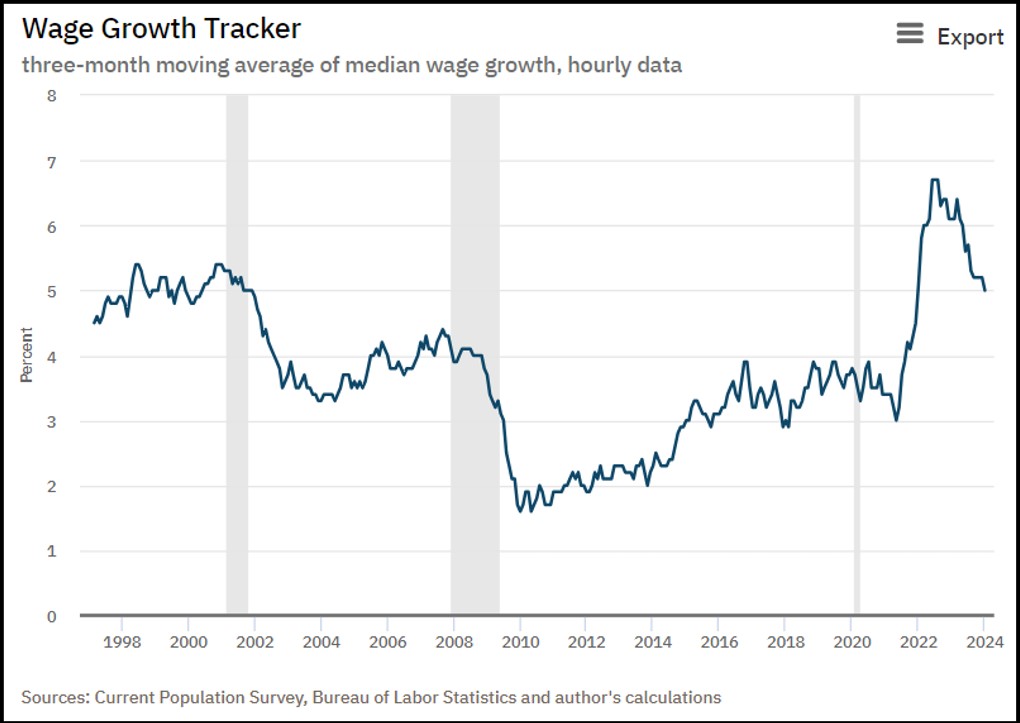

- Over the last four weeks, the Three-Year-Old Index fell an aggregate of 1.0%. Those same four weeks delivered an average decline of 0.1% between 2014 and 2019.

- Over January, daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 99.6%, meaning market prices were just below MMR values but moved higher than year-end.

- The average daily sales conversion rate increased to 56.0%, which indicates that demand was improving relative to year-end and normal for this time of year. For comparison, the daily sales conversion rate averaged 55.5% in January during the last three years.

Manheim: Source

The Manheim 3-year-old index is shaping up to look like 2019 performance in 2024 which will make for a good year.

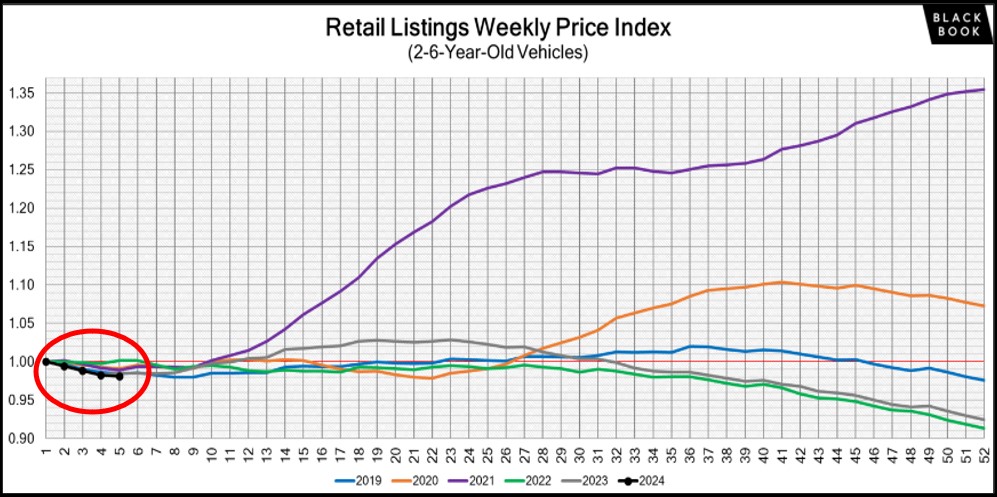

Black Book: Source

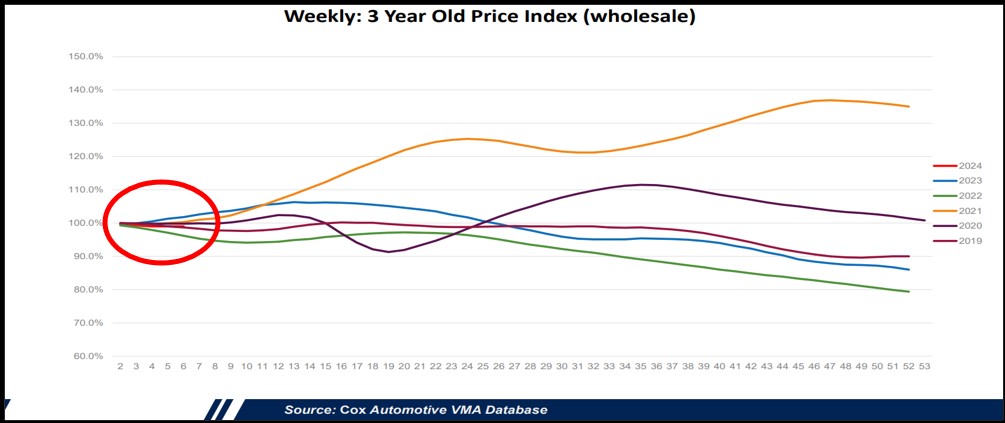

The Black Book 2 to 6-year-old index is shaping up to look like 2023 performance in 2024 which will make for a good year.

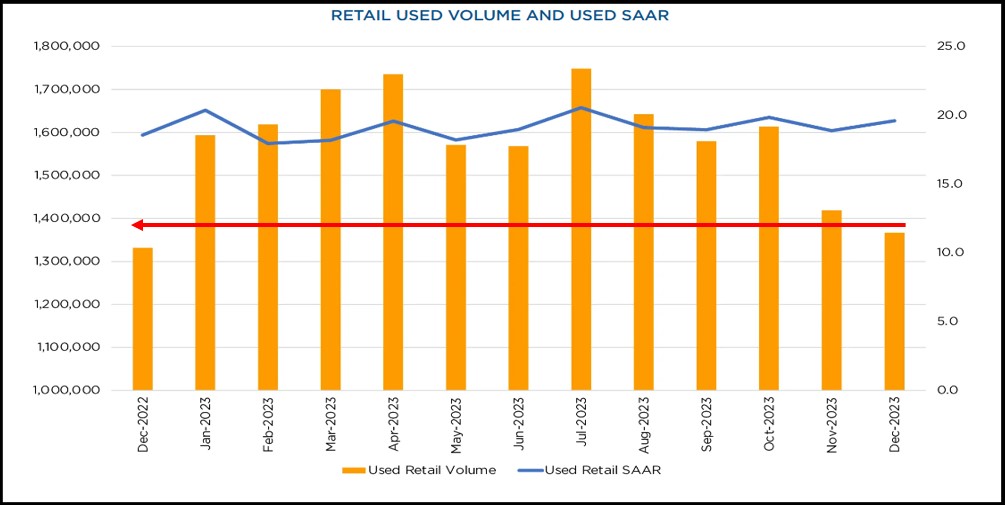

Retail Sales Market Outlook: Source

In November last year we saw an increase over November 2023 and last month December 2023 beat December 2022 in retail sales volume. That’s an indication that January through April could look much like we see below.

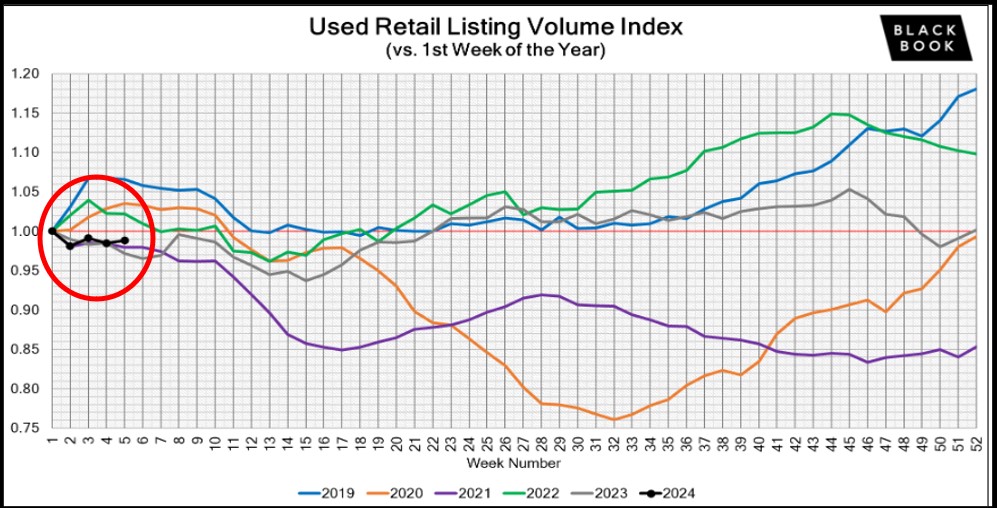

Retail Supply Market Outlook: Source

The market is showing signs of appreciation we expected and should continue this trend through tax season which impacts acquisition strategies as well as aging policies.

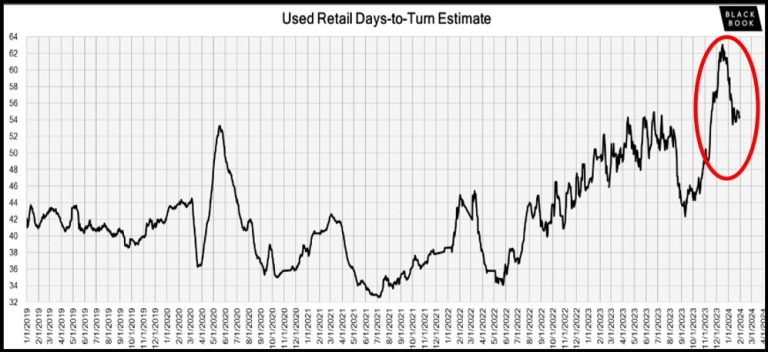

Used car turn is sitting at 54 days down from 63 days and holding steady and should decrease even further as we move closer into tax season and the spring bounce.

Summary: Source

Job growth reaccelerated to stronger-expected heights in January. January saw 353,000 jobs created when 185,000 had been expected. The prior two months were revised up for a net increase of 126,000 more jobs than originally estimated.

The new vehicle sales pace declined to the slowest since March 2023 and with affordability driving demand in 2024, we can expect, as Cox Automotive Forecasted, New car sales to stay stagnant throughout the year, despite supply. America’s car dealers started the month of October with about 2.26 million unsold cars on lots — 8% fewer than a year ago. The average transaction price (ATP) in the United States for new vehicles in January is expected to be $45,106, down $1,636 from the same period in 2023.

At current sales rates, 2.26 million is about a 47-day supply of used cars. That’s well below the 60-day supply car dealers traditionally aim to keep in stock. The number of used vehicles available for purchase has remained higher than the low point seen in early April, but Kelley Blue Book analysts expect used car prices to remain generally high for several years. Automakers built about 8 million fewer cars during the pandemic. Used car inventories could remain low for years as those cars never find their way to the used market, keeping prices higher than Americans had grown accustomed to.