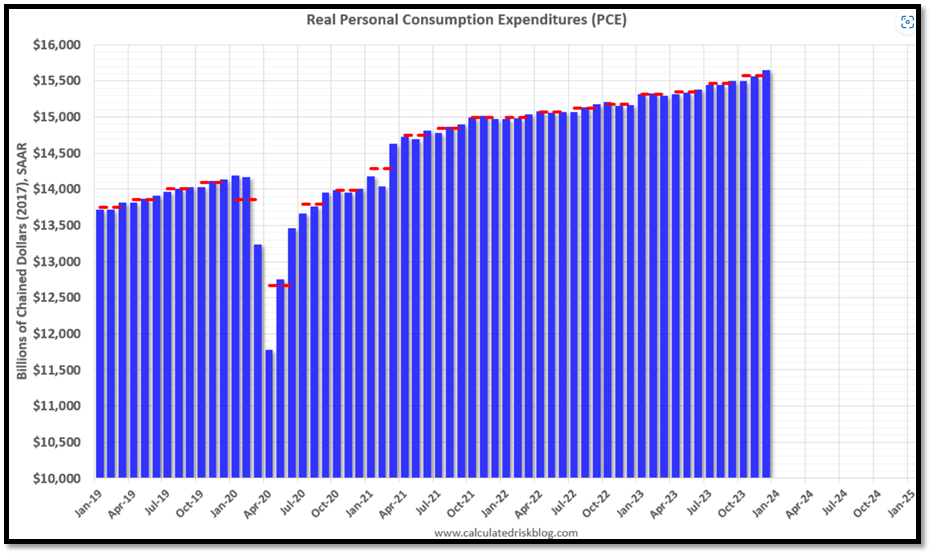

Economic Outlook: Source

- The core personal consumption expenditures price index for December, an important gauge for the Federal Reserve, increased 0.2% on the month and was up 2.9% on a yearly basis.

- Including volatile food and energy costs, headline inflation also rose 0.2% for the month and held steady at 2.6% annually.

- Consumer spending increased 0.7%, stronger than the 0.5% estimate. Personal income growth edged lower to 0.3%, in line with the forecast.

Wholesales to Retail Trending:

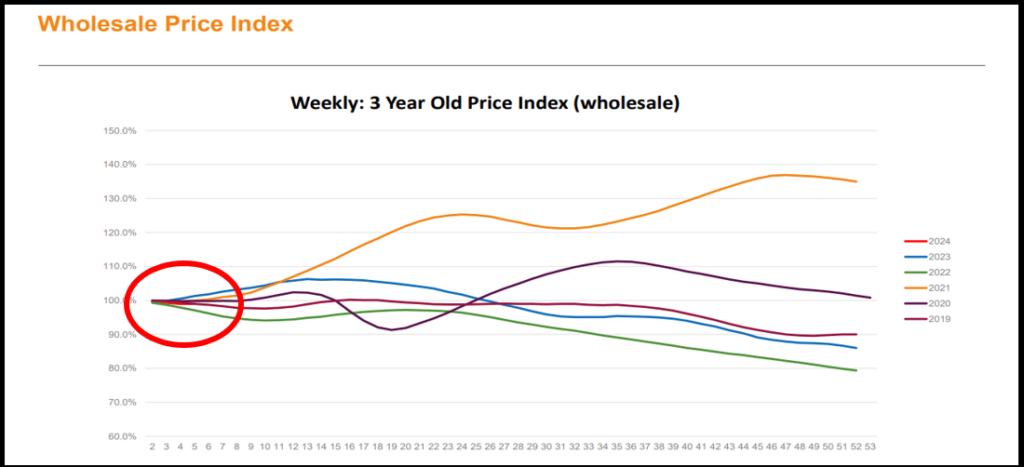

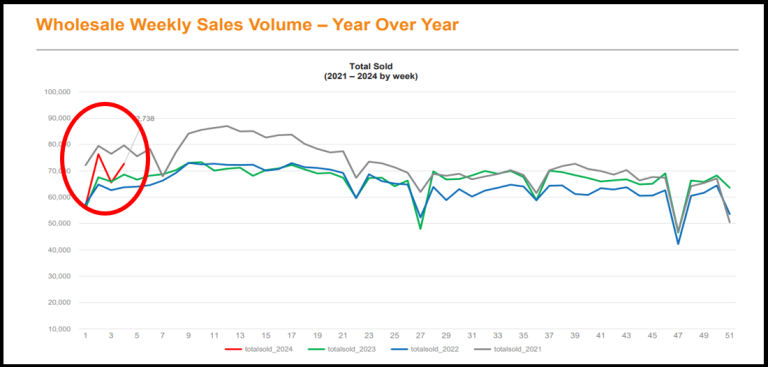

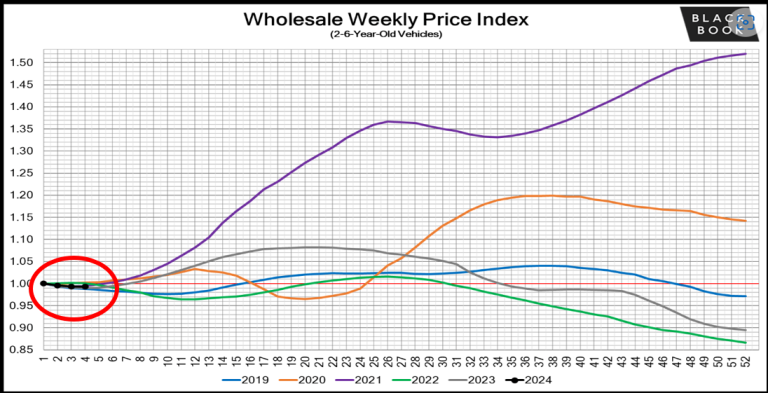

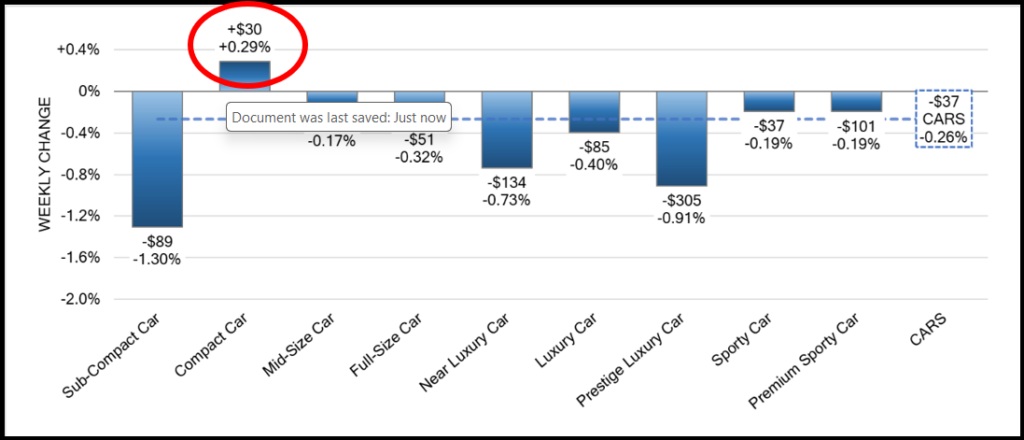

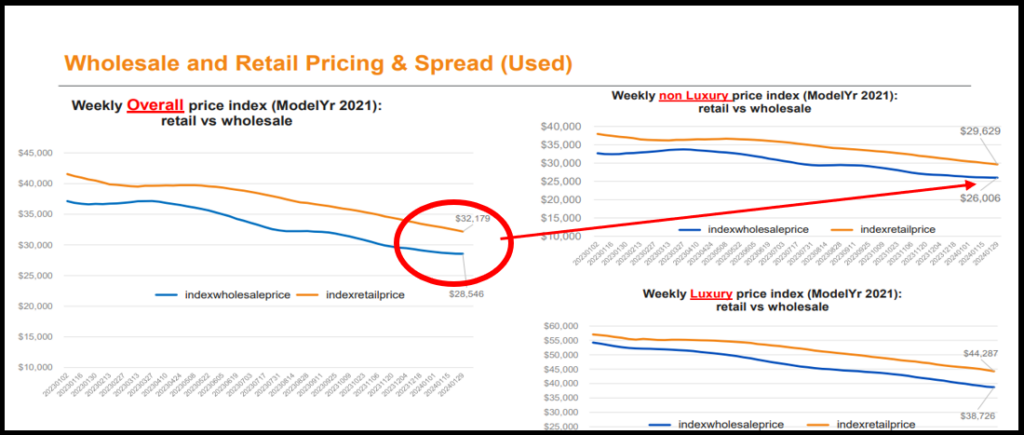

The market rebounded last week from the bad weather the previous week. The wholesale market is showing signs of the Spring market. Three-year-old wholesale depreciation was flat, with non-luxury models increasing by 0.1% (this is usually the first group to appreciate during the Spring market). Lane efficiency improved, and sale prices moved closer to MMR. Used and new retail sales improved, pushing down days’ supply.

- Week after week, 3-year-old wholesale values were flat.

- Lane efficiency improved week over week.

- Week over week, non-luxury retail values decreased 0.7%, and luxury decreased 0.9%.

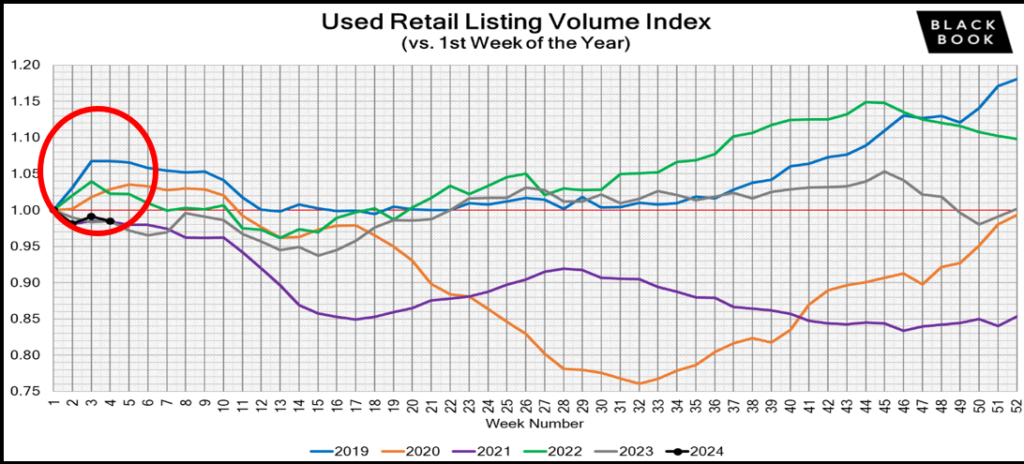

- Recovering from a week of bad weather, the used retail sales rate was strong last week.

- New car sales also rebounded last week. The stronger rate of sales pushed days’ supply down to 75.

- Used-vehicle inventory rose to 2.39 million units in December.

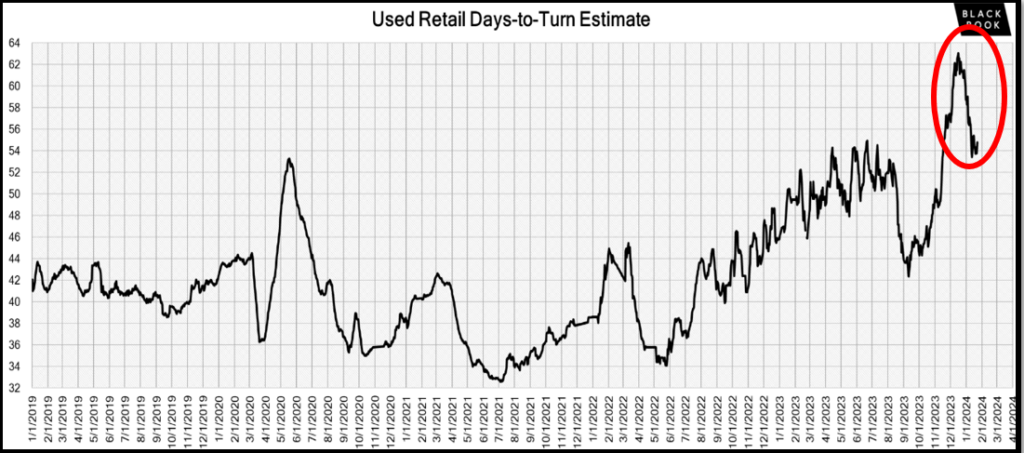

- Used days’ supply stood at 56, the same as in November.

- The average used vehicle listing price increased slightly but remained below $27,000.

Manheim:

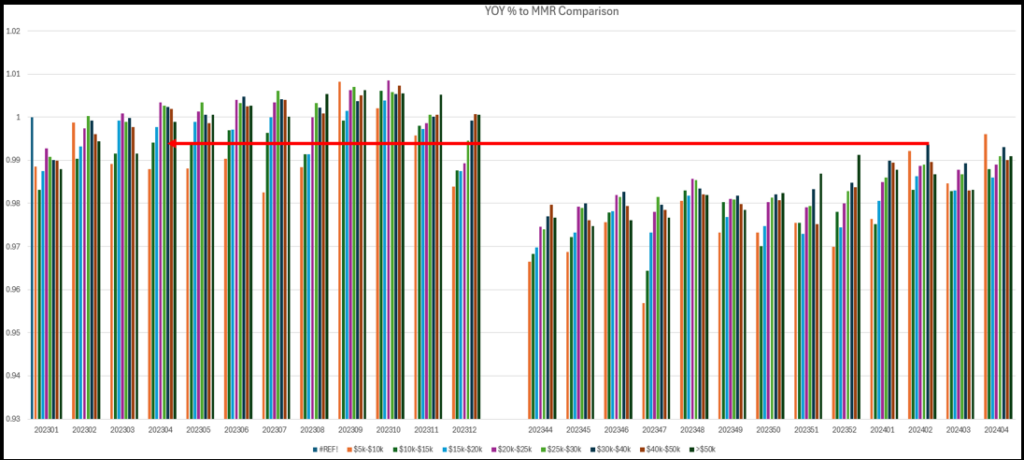

Looking below, you can see the performance of vehicle values % to MMR by vehicle price point and week over the last Quarter of 2023 and the first Quarter of 2024.

Black Book: Source

The current market is exhibiting a deceleration in the depreciation rate, with a decline of only -0.33% this week, which is slightly lower than the average pre-pandemic rate of -0.39% for the corresponding period. Moreover, vehicles ranging from 8 to 16 years in age are demonstrating modest gains of spring, with five segments experiencing increases last week.

Retail Sales Market Outlook: Source

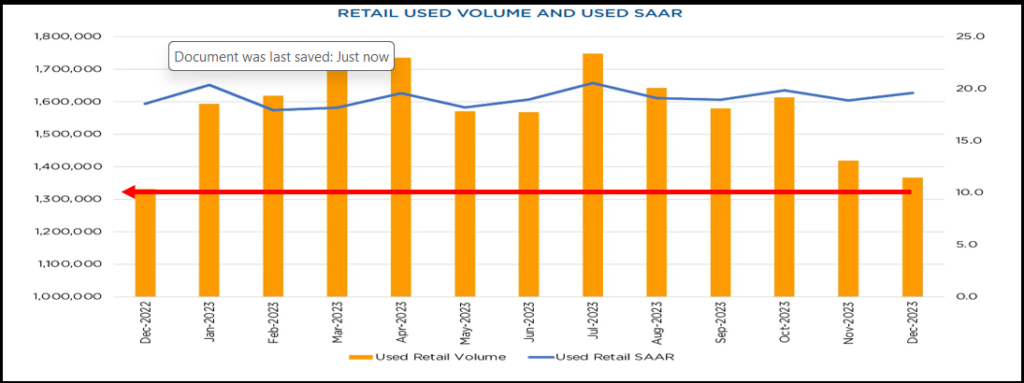

In November last year, we saw an increase over November 2023, and last month, December 2023 beat December 2022 in retail sales volume. That’s an indication that January through April could look much like we see below.

Summary:

The markets are moving as expected, and it is expected that as the wholesale value increases, four to six weeks later, the retail markets should follow. We are seeing a substantial rise in low price point vehicle prices due to affordability and the market is reacting. The projection is that tax season will continue this trend until early to late April before we see a softening in the market.