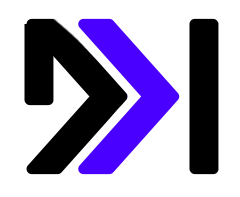

Economic Outlook: Source

The overall economy is stable with employment conditions and buyer confidence in the moderate range but wages and buyer ability showing signs of strength.

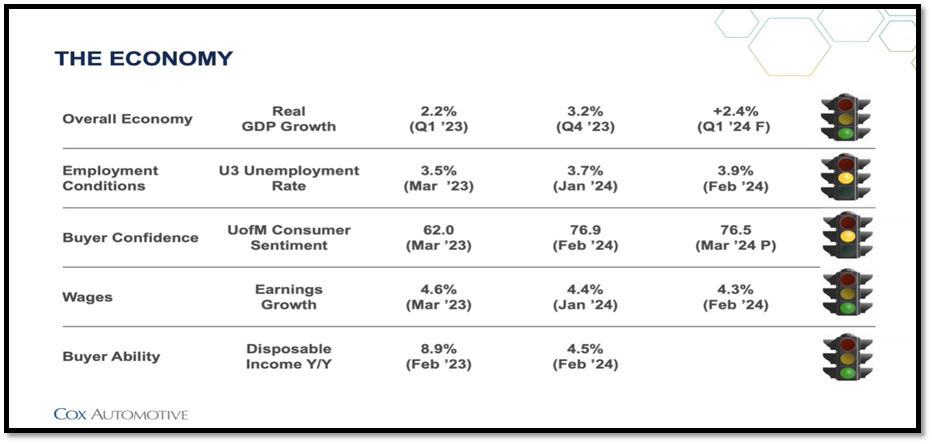

Dealers are feeling moderately optimistic right now as tax season gives us a slight lift in sales however dealers are still feeling less optimistic than this time last year and the year before.

New and Used Retail Sales and Day Supply Trending: Source

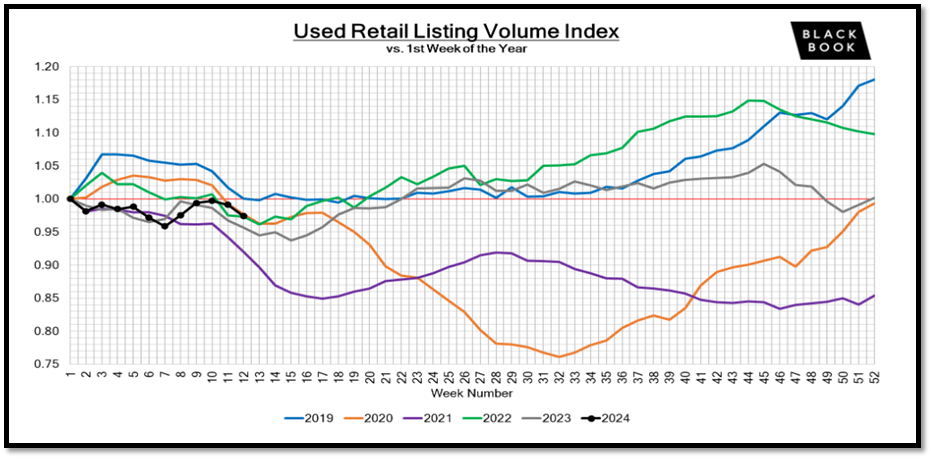

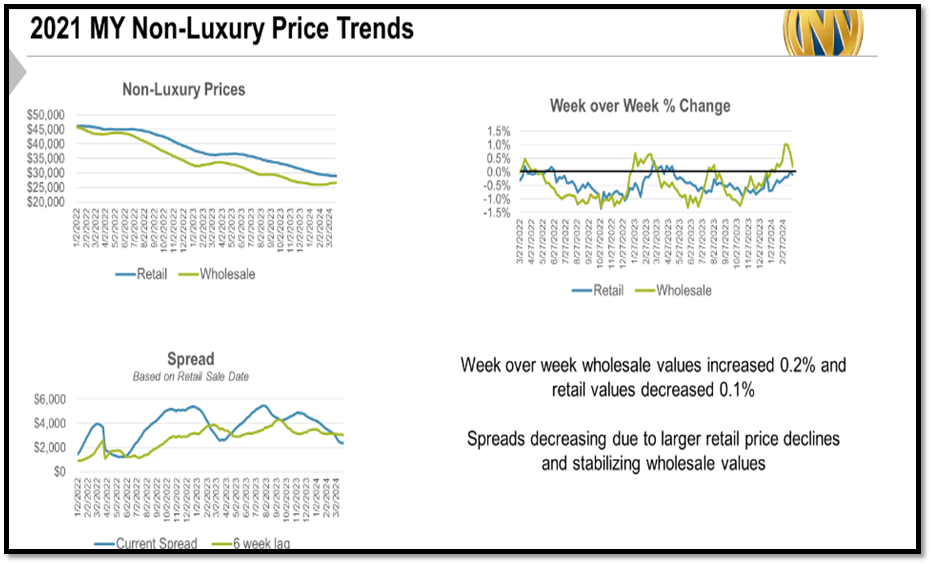

- Retail prices decreased slightly. Spreads continue to drop due to increasing wholesale values and flat or decreasing retail values.

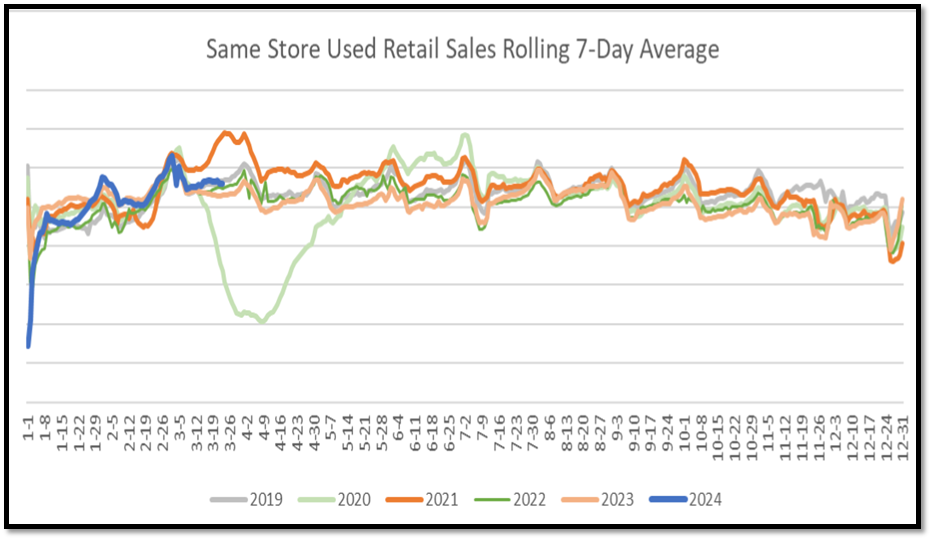

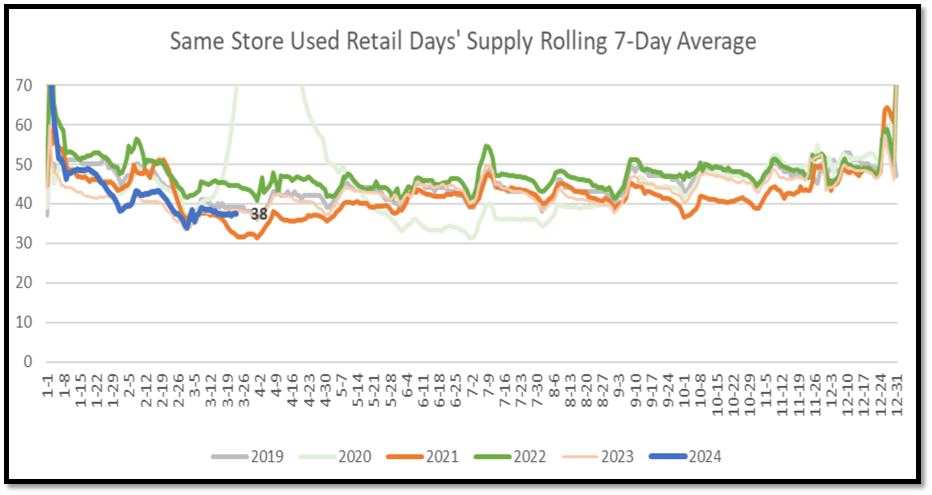

- With less inventory, the used retail sales rate is currently running close to 2019 levels. Days’ supply is still low at 38 days.

- New car sales continue to trend like 2019 but inventory also continues to build. Days’ supply moved down needs-demand-driven.

Manheim Wholesales Market Source

The Spring wholesale market continues to slow. Three-year-old wholesale values increased 0.1% (+0.5% last week), lane efficiency decreased and sale prices below MMR. Used retail sales trending close to 2019 levels and days’ supply is still relatively low. New car sales are also trending close to 2019 levels, but inventory continues to accumulate.

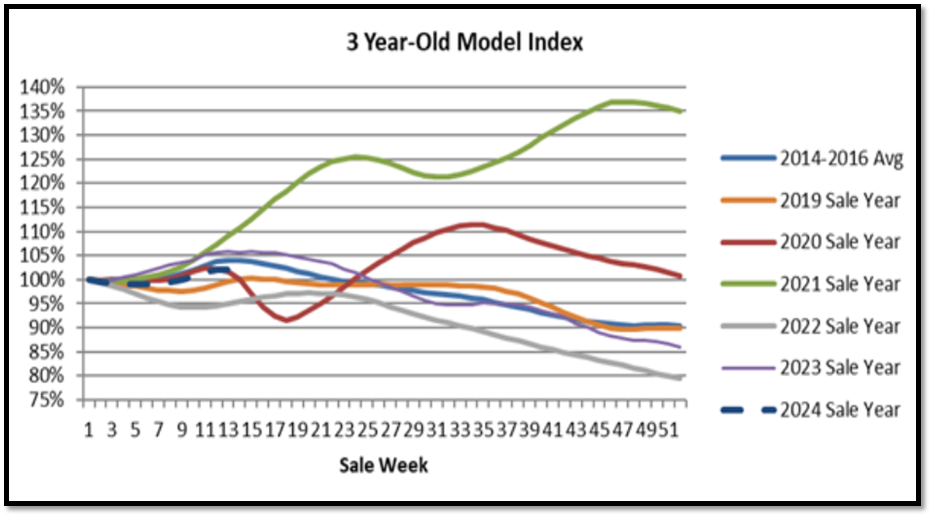

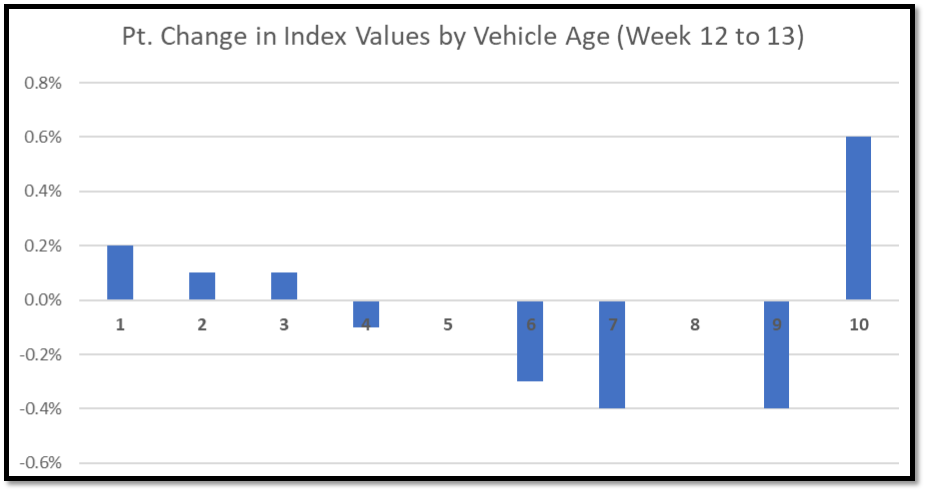

- The 3-year-old index moved up 0.1% to 102.1%. Luxury decreased 0.2% and non-luxury increased 0.2

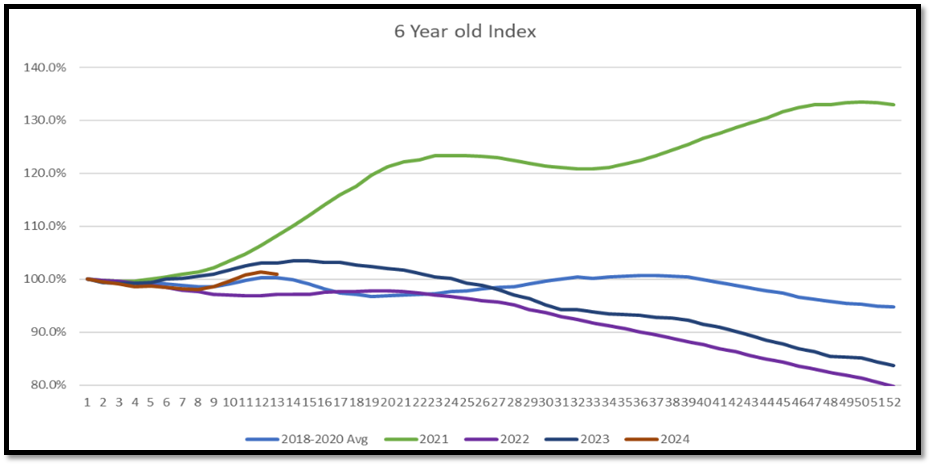

- Wholesale values started decreasing for the older model year.

- Sale prices slightly below MMR (-0.64%).

- Lane efficiency is starting to drop some.

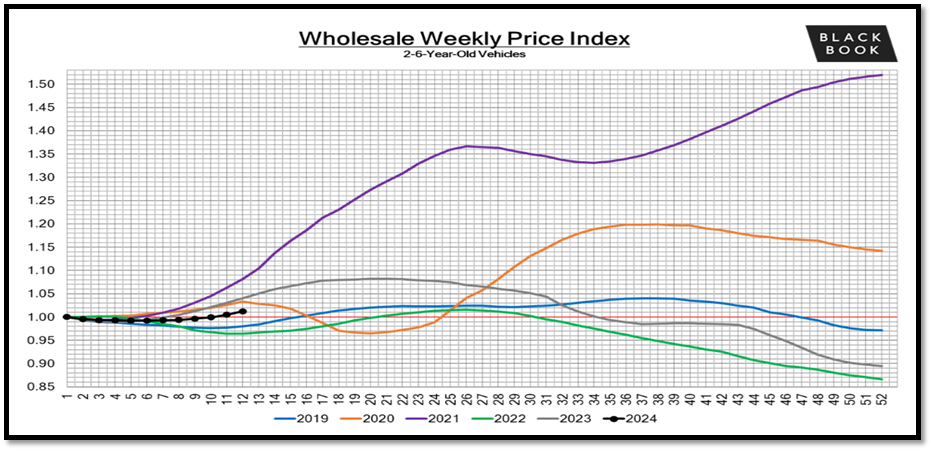

Black Book: Source

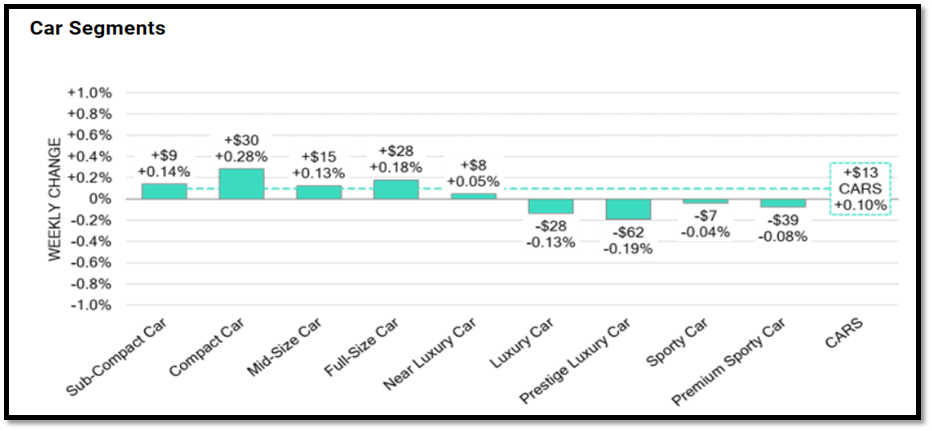

- On a volume-weighted basis, the overall Car segment increased +0.10%. For reference, in the previous week, cars increased +0.02%.

- The 0-to-2-year-old Car segments were up +0.01% and 8-to-16-year-old Cars increased +0.18%.

- Five of the nine Car segments increased last week.

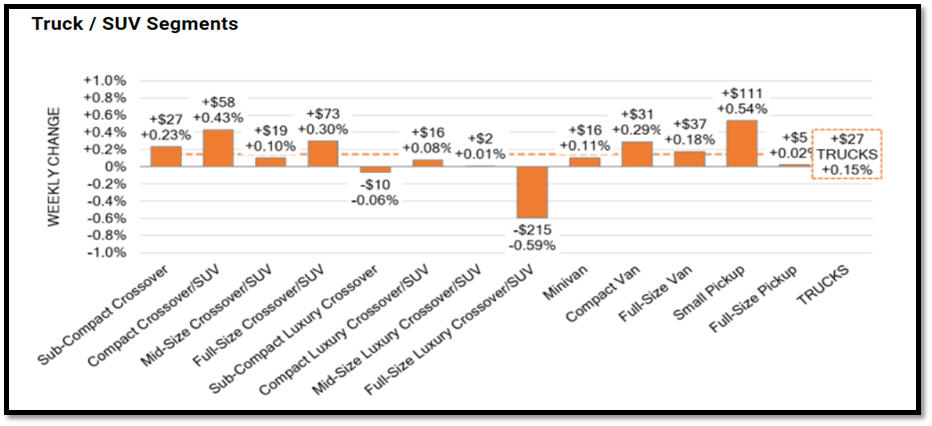

- The volume-weighted, overall Truck segment increased +0.24% compared to the appreciation seen the prior week of +0.24%.

- The 0-to-2-year-old models gained +0.06% on average and the 8-to-16-year-olds increased by +0.13% on average.

- Eleven of the thirteen Truck segments increased last week.

Vehicle Acquisition Values & Trends:

- to 10-year-old vehicles are growing in appreciation each week with week 9 showing growth of over 1% for 4- to 10-year-old vehicles which are in the highest the main category during tax season. You can see that below in the gray and orange line.

Retail Margin Trending

The market is taking margin away from both luxury and non-luxury and suggests that turn and departmental gross is the focus for success in this market.

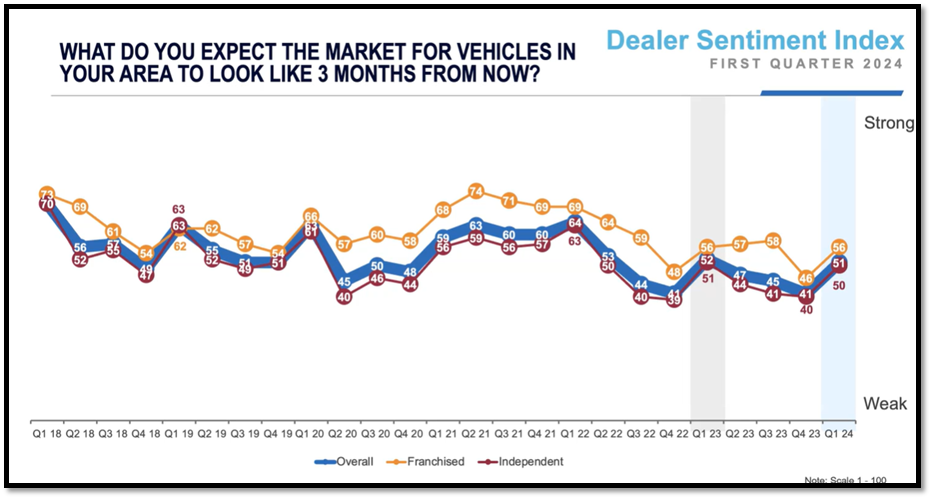

Summary: Source

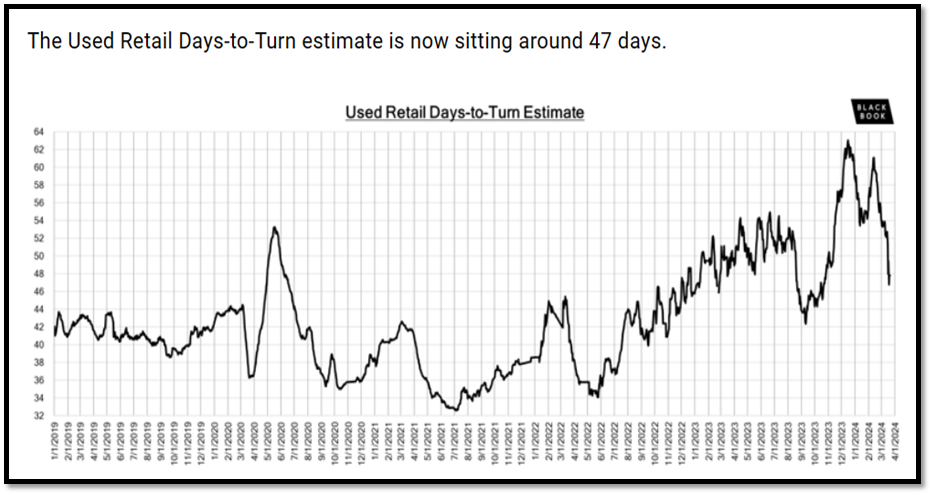

According to Cox Automotive’s recent dealer survey, the top three things that dealers feel are holding back growth are interest rates, the economy, and market conditions. The political environment and expense structure along with consumer credit availability come in next. With limited used car inventory, margins are compressed but consumer confidence is up. Holding inventory, it’s not favorable in this market and inventory turn is where marginal profits can be made, and losses avoided.

Coming off a strong new car month in February and trending strong in January, Cox Auto has published an updated 2024 forecast for new car SAAR and Used Vehicle values you can see below:

The pivot is just ahead. The market is up and down week after week and new car sales hit an all-time high in February. With interest rates and unemployment on everyone’s mind, it can be easy to become fearful and cautious. However, this is a growth market if the strategy is evidenced with data and market trends that keep the accelerator down while also being risk averse. Reach out to the team to review your strategy at info@theautomtoiveadvisorteam.com.